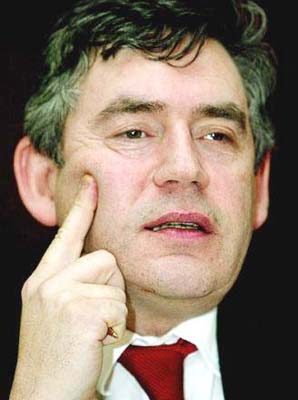

Gordon Brown in move to stem "toxic debt" crisis

London - Gloomy weather, rising credit card debt and abandoned New Year resolutions conspire to make the third Monday in January the most depressing day of the year, British psychologists have found.

London - Gloomy weather, rising credit card debt and abandoned New Year resolutions conspire to make the third Monday in January the most depressing day of the year, British psychologists have found.

On Monday, their research provided a suitably bleak background to an announcement by Prime Minister Gordon Brown that his government would step in to protect banks from so-called toxic assets in an effort to unfreeze lending and soften the blow of a deepening recession.

Just three months ago, when Britain became the first major industrialized nation to launch a massive recapitalization scheme to stabilize the banking sector - a step later copied by other European countries - the government would have been loath to intervene again after such a short space of time, the Financial Times said Monday.

"But we are now in a position where the dangers of doing too much are far smaller than the dangers of doing too little," the paper said.

Rocketing "bad debt" from banks - highlighted Monday by the revelation that the Royal Bank of Scotland (RBS) is likely to have incurred losses of a record 28 billion pounds (41 billion dollars) in 2008 - were among factors behind the renewed government action.

So-called toxic debt of British banks, resulting from risky lending practices when the times were good, are expected to total 200 billion pounds for 2008.

By launching an insurance scheme to protect banks from toxic assets Brown hopes to unblock the lending freeze that has continued to strangle the economy despite last October's 37-billion-pound recapitalization scheme and the part-nationalization of major banks.

"The government is the only organization that can step in when markets fail," Brown said Monday, making clear that he was "very angry" with banks such as RBS which had taken "irresponsible" risks.

He singled out the Edinburgh-based bank, Britain's third-largest, for overreaching itself in leading the acquisition of Dutch giant ABN Amro in 2007, and for having to write off a 2.5-billion-pound loan to a Russian oligarch who had fallen on hard times.

Brown knows that the publication of 2008 annual results by major banks over the next few weeks will unveil the true scale of write- downs - and bring further dismal news for the British economy.

The outlook, already marred by the prospect of rising unemployment and a record number of insolvencies in 2009, was compounded by forecasts from the European Commission Monday which showed that the British economy will fare worst among leading EU members.

According to the EU, Britain's Gross Domestic Product (GDP) is set to shrink by 2.8 per cent in 2009, more by far than that of the other leading economies, while the government budget deficit is estimated to rise to 8.8 per cent of GDP in 2009, and 9.6 per cent of GDP the following year.

Brown knows that if credit does not become more readily available, the recession will deepen and bank losses will rise even beyond the alarming forecasts, experts said Monday.

"If anything, this is a revival plan for the British economy," one analyst said.

Some critics said the government had issued the banks with a "blank cheque" in what was a just a prelude to the full-scale nationalization of banks.

With public anger mounting at the vast amounts of taxpayers' money spent on saving the banks, the latest moves could fall foul of popular support, conservative commentators warned Monday.

"We are a nation on the brink of going bankrupt," the conservative Daily Mail said, adding that it was Brown, in his previous role at the Treasury, who presided over a decade of "binge lending" and lax banking regulations. (dpa)