GBP/USD Daily Commentary for 3.11.09

The Pound has depreciated against the Dollar over the past 24 hours despite the enormous rally in U. S. equities on Tuesday. The nationalization of Lloyd’s bank is obviously not sitting well with investors.

The BOE is treading water playing with nationalization and quantitative easing since the approach has proven unsuccessful in the past. Hence, investors continue to punish the Cable. To make matters worse, Britain reported a Trade Balance below expectations, revealing that the economy continues to import far more than it exports.

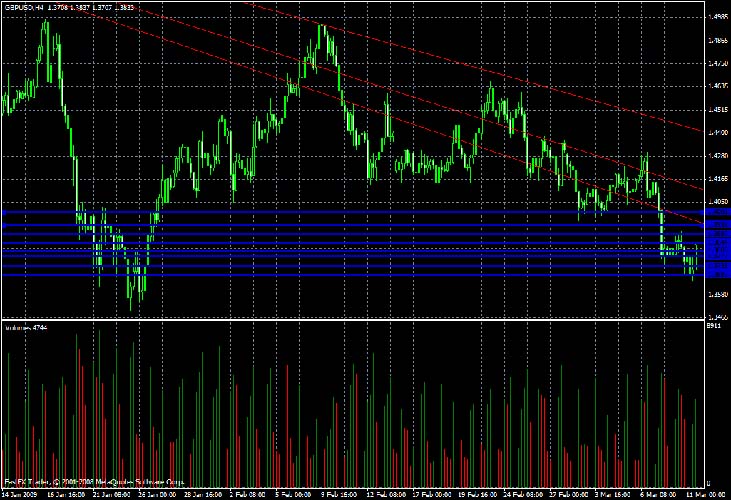

A negative Trade Balance is normally highly negative for the home currency. Hence, investors aren’t biting on the rally taking place on Wall Street. The GBP/USD remains far below all of our downtrend lines.

While we may see the continuation of its near-term rally, we hold our negative outlook trend wise. Fundamentally, we find resistances of 1.3844, 1.3877, 1.3936, and 1.4001. To the downside, we see supports of 1.3805, 1.3777, 1.3726, and 1.3683.

The 1.40 level serves as a psychological barrier to the upside with 1.35 playing as a cushion to the downside. The GBP/USD is currently exchanging at 1.3833.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.