Dell committee backing Silver Lake offer

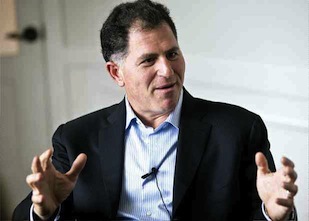

A special committee entrusted with the task of evaluation investment proposals in computing giant, Dell has said that it is backing a buyout proposal by Silver Lake Partners and founder Michael Dell that offers $13.65 a share to the shareholders.

A special committee entrusted with the task of evaluation investment proposals in computing giant, Dell has said that it is backing a buyout proposal by Silver Lake Partners and founder Michael Dell that offers $13.65 a share to the shareholders.

The backing of the proposal is a major setback for activist investor Carl Icahn, who has offered a deal with $12 a share special dividend. The special committee has written to the shareholders of Dell recommending them to vote in favour of Silver Lake and Michael Dell's takeover during the company's shareholder meeting on July 18, 2013.

"Dell's independent directors unanimously recommend that you vote to approve the transaction by voting FOR the Michael Dell/Silver Lake merger agreement," it wrote.

Icahn, Southeastern and other large independent shareholders such as T. Rowe Price have already said that they will not vote in favour of Silver Lake's buyout offer. Carl Icahn and Southeastern Asset Management might continue to ask that the company pay a special dividend from its cash and financing. These two investors have proposed an alternative deal for Dell that would allow the shareholder to continue to hold their shares in the company.

The two investors have written a letter to the Board of directors of Dell proposing to allow Dell shareholders to keep holding stock in the company and take additional US$12 a share in cash or stock. Icahn and South-eastern, both of which hold a significant stake in the company, had proposed their alternative plan in the month of March.