Crude Daily Commentary for 4.30.09

Weekly crude oil inventories skyrocketed again, coming in 3.1 million barrels above analyst expectations. The pattern of rising inventories implies a corresponding decline in demand, supported by yesterday's disappointing Prelim GDP number. Another driving force behind the flood in inventories could also be the rise in U. S. oil imports from the likes of Brazil and Russia, providing a counter punch to OPEC's steep cuts in production. Adding to demand worries is today's announcement that Chrysler is officially heading for bankruptcy. Chrysler's bankruptcy highlights the fact that there are fewer cars on the road burning gas, taking a bite out of crude consumption.

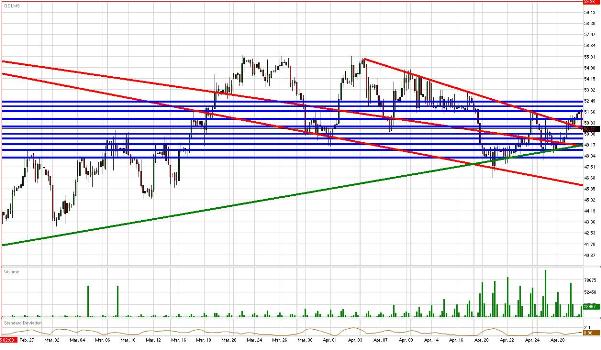

These negative price shocks combined would normally result in a steep sell off in crude futures. However, the fundamentally significant gains made by equities over the last 24 hours are helping offset the inclination to sell crude. Even though crude futures are presently dangling below our 3rd tier downtrend line, they remain comfortably above the highly psychological $50/bbl level. Therefore, any near-term weakness in crude should be fought off by rising U. S. equities and the psychological support.

That being said, we wouldn't be surprised to see crude touch our $49.99/bbl support today due to the news of higher supply and falling production. However, if this support doesn't hold we could see the downturn pickup speed towards our uptrend line. As for the upside, crude futures would need a huge reversal in momentum with daily highs hanging in the distance.

Fundamentally, we find supports of $49.99/bbl, $49.66/bbl, $49.22/bbl, $48.78/bbl, and $50.37/bbl. To the topside, we see resistances of $50.55/bbl, $51.13/bbl, $51.70/bbl, $52.08/bbl, and $52.41/bbl. $50/bbl turns becomes a key psychological cushion again while $55/bbl serves as a psychological cushion. Crude is presently trading at $50.37/bbl.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.