Crude Daily Commentary for 3.6.09

Crude futures recovered from their losses on Thursday despite another day of crashing U. S. equities. With U. S. inventories declining and investors expecting increasing supply cuts coming from OPEC on March 15th, crude is finding considerable strengthen despite the economic turmoil in America.

Furthermore, China continues to build their stockpiles of crude, taking advantage of what the government views as bargain prices for the essential commodity.

However, U. S. unemployment is rising at a hurried pace while the economy deteriorates, placing a downward pressure on crude that is preventing it from breaking out to huge gains.

Due to crude's resilience, we have a positive near-term outlook on crude futures even if the U. S. unemployment rate comes in higher than expected today.Should crude futures rise above March highs, we anticipate heightened near-term gains.

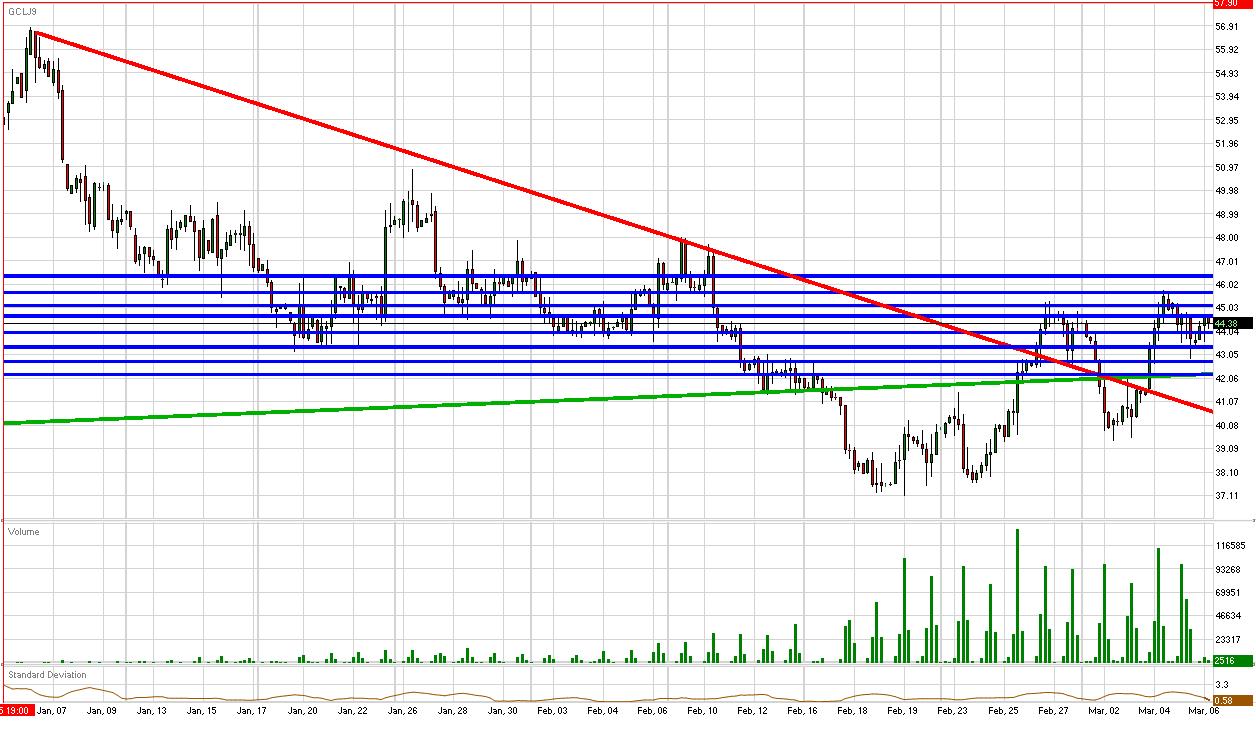

Fundamentally, we maintain our supports of $43.99/bbl, $43.39/bbl, $42.77/bbl, and $42.22/bbl.

The $40/bbl area remains a reliable psychological cushion for the near-term, while the $45/bbl area acts as a psychological barrier.

To the topside, we hold our resistances of $44.68/bbl, $45.13/bbl, $45.68/bbl, and $46.38/bbl.

Crude futures are currently trading at $44.45/bbl.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.