Crude Daily Commentary for 3.31.09

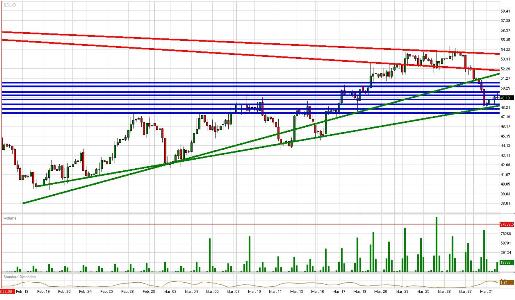

Crude bounced off our 1st tier uptrend line beautifully yesterday after a massive selloff in reaction to the possible bankruptcy of GM and Chrysler. As we stated in our previous post, the failure of the major U. S. auto manufacturers takes a large bite out of demand from several sides.

Higher unemployment implies a reduction in automobile purchases and consumption of crude. Additionally, we must consider the crude utilized to both manufacture and distribute the automobiles. With the S&P below 800 and global consumption and production levels coming into question again, there were sufficient reasons to send crude futures tumbling lower.

Crude futures are trying to recover Tuesday morning but are struggling mightily with the psychological $50/bbl level. Despite the bounce taking place right now, the debilitating downtrend resurfaced in a hurry.

While investors may stabilize crude futures a bit during today's session, all eyes will be on Japan's release of its Tankan Manufacturing Index tomorrow. The U. S. will follow with manufacturing and employment data of its own, not to mention the weekly crude oil inventory number. Therefore, the 1st tier uptrend line will sure be tested in the next 24-48 hours.

If the uptrend can't hold, then we could see another massive near-term selloff in both crude and the S&P futures. However, before we get ahead of ourselves, the uptrend is still intact and we'll have to take a wait and see approach.

Fundamentally, we find resistances of $49.49/bbl, $49.81/bbl, $50.41/bbl, and $50.79/bbl. To the downside, we see supports of $49.11/bbl, $48.51/bbl, $48.03/bbl, and $47.61/bbl. The crude futures are presently trading at $49.21/bbl.

Copyright 2009 FastBrokers, Latest Forex News and Analysis for Forex, Bullion and Commodity Traders.

Disclaimer: For information purposes only. FastBrokers assumes no responsibility or liability from gains or losses incurred by the information herein contained. There is a substantial risk of loss in trading futures and foreign exchange.