Commodity Trading Tips for Nickel by KediaCommodity

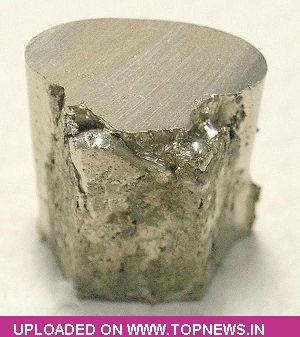

Nickel settled down -0.58% at 1122.9 after inventories continued to rise. Data showed inventories at LME warehouses rose by 2,256 tonnes to a record high 324,984 tonnes, highlighting an overhang of supply. Investors are counting on shortages developing after Indonesia cut off unprocessed nickel ore exports in January, but a legacy of past overproduction means that plentiful stocks will have to be worked off first. China’s new home sales prices were reportedly down for a third straight month in July, indicating the downturn in housing market was still impairing China’s growth. Foreign direct investment also dropped unexpected for the first time in 17 months, as manufacturing companies in Japan, Europe and the US cut spending. In the US, the NAHB home price index was beat forecast in August. In other news, the Russia-Ukraine tension eased some after Western governments announced to make further efforts to defuse the crisis. LME nickel, the best performing base metal so far this year with gains of 34 percent, slipped 0.8 percent to close at $18,495 a tonne. LME nickel prices opened at USD 18,702/mt overnight, with the high end of the price range USD 18,744/mt, and finding support at USD 18,425/mt. Finally, LME nickel prices closed at USD 18,500/mt, down USD 163/mt from the previous trading day. US July inflation rate, housing starts as well as construction permits scheduled for release today are optimistic. Technically market is under fresh selling as market has witnessed gain in open interest by 6.51% to settled at 4349 while prices down -6.5 rupee, now Nickel is getting support at 1115.6 and below same could see a test of 1108.4 level, And resistance is now likely to be seen at 1133.4, a move above could see prices testing 1144.

Nickel settled down -0.58% at 1122.9 after inventories continued to rise. Data showed inventories at LME warehouses rose by 2,256 tonnes to a record high 324,984 tonnes, highlighting an overhang of supply. Investors are counting on shortages developing after Indonesia cut off unprocessed nickel ore exports in January, but a legacy of past overproduction means that plentiful stocks will have to be worked off first. China’s new home sales prices were reportedly down for a third straight month in July, indicating the downturn in housing market was still impairing China’s growth. Foreign direct investment also dropped unexpected for the first time in 17 months, as manufacturing companies in Japan, Europe and the US cut spending. In the US, the NAHB home price index was beat forecast in August. In other news, the Russia-Ukraine tension eased some after Western governments announced to make further efforts to defuse the crisis. LME nickel, the best performing base metal so far this year with gains of 34 percent, slipped 0.8 percent to close at $18,495 a tonne. LME nickel prices opened at USD 18,702/mt overnight, with the high end of the price range USD 18,744/mt, and finding support at USD 18,425/mt. Finally, LME nickel prices closed at USD 18,500/mt, down USD 163/mt from the previous trading day. US July inflation rate, housing starts as well as construction permits scheduled for release today are optimistic. Technically market is under fresh selling as market has witnessed gain in open interest by 6.51% to settled at 4349 while prices down -6.5 rupee, now Nickel is getting support at 1115.6 and below same could see a test of 1108.4 level, And resistance is now likely to be seen at 1133.4, a move above could see prices testing 1144.

Trading Ideas:

Nickel trading range for the day is 1108.4-1144.

Nickel settled down -0.58% after inventories continued to rise.

Investors are counting on shortages developing after Indonesia cut off unprocessed nickel ore exports in January

US July inflation rate, housing starts as well as construction permits scheduled for release today are optimistic.