Commodity Trading Tips for Nickel by KediaCommodity

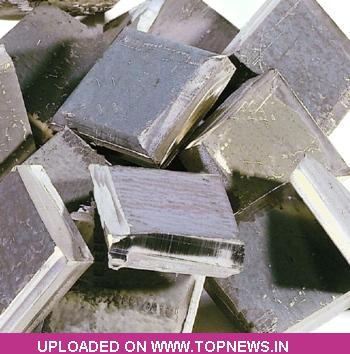

Nickel yesterday traded with the positive node and settled 0.25% up at 928.40 tracking LME nickel prices overnight opened at $16,260/mt, with the high end $16,500/mt, finding support at $16,225/mt. Finally, LME nickel prices closed at $16,358/mt, up $18/mt. Spain's 10-day government bond yields fell 2 basis points to 6.61%, while Italy's 10-day government bond yields dropped 4 basis points to 6.02%, boosting LME nickel prices. But since US jobless claims were lower than expected, LME nickel prices gave back gains and closed at $16,358/mt, up $18/mt. $ADP Employer Services released the 133,000 jobs were added in May, higher than previous 119k, but lower than 150k expected. The number of jobless claims for last week was 383k, higher than the previous figure and the forecast of 370k. Market confidence improved on news that European officials will support the banking sector in capital restructuring and form an alliance in the sector. China's May CPI will be released today, which is expected to fall to 52%, down from April's 53.3%. Slower expansion in the manufacturing sector shows economic growth further slid. For today's session market is looking to take support at 923.2, a break below could see a test of 918.0 and where as resistance is now likely to be seen at 933.5, a move above could see prices testing 938.6.

Nickel yesterday traded with the positive node and settled 0.25% up at 928.40 tracking LME nickel prices overnight opened at $16,260/mt, with the high end $16,500/mt, finding support at $16,225/mt. Finally, LME nickel prices closed at $16,358/mt, up $18/mt. Spain's 10-day government bond yields fell 2 basis points to 6.61%, while Italy's 10-day government bond yields dropped 4 basis points to 6.02%, boosting LME nickel prices. But since US jobless claims were lower than expected, LME nickel prices gave back gains and closed at $16,358/mt, up $18/mt. $ADP Employer Services released the 133,000 jobs were added in May, higher than previous 119k, but lower than 150k expected. The number of jobless claims for last week was 383k, higher than the previous figure and the forecast of 370k. Market confidence improved on news that European officials will support the banking sector in capital restructuring and form an alliance in the sector. China's May CPI will be released today, which is expected to fall to 52%, down from April's 53.3%. Slower expansion in the manufacturing sector shows economic growth further slid. For today's session market is looking to take support at 923.2, a break below could see a test of 918.0 and where as resistance is now likely to be seen at 933.5, a move above could see prices testing 938.6.

Trading Ideas:

Nickel trading range for the day is 918.07-939.

Nickel gained as Spain's 10-day government bond yields fell 2 basis points to 6.61% boosting prices

Market confidence improved on news that European officials will support the banking sector in capital restructuring

USD ADP Employer Services released the 133,000 jobs were added in May, higher than previous 119,000