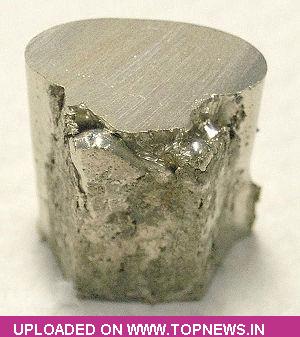

Commodity Trading Tips for Nickel by Kedia Commodity

Nickel yesterday settled down -0.53% at 812 as the Chinese government said it will audit government debt and assess debt risks of local governments this week, compounding worries over demand from the world's second largest economy. Latest data showed the Chinese economy has slowed down. However, anticipation that the US Federal Reserve will keep QE3 in place offset worries over demand in China. As a result, commodity prices bounced back from lows. However, sales of second-hand home in the US continued to drop in June, constraining the upside space of base metals prices. Base metals had little upward momentum after US shares fell back. The market was cautious before the US Federal Reserve announces its interest rate decision. Annualized US pending home sales in June was 10.9%, lower than both expectations and May, while monthly rate dropped by 0.4%, compared to a growth of 6.7% in May. That is because mortgage interest rates began to rise since May, which affected home sales in June, while contracts signed also decreased due to low inventories. Dallas Fed's manufacturing index for July recorded 11.4, much lower than 17.1 expected, and this weighed down US stocks. Due to tight liquidity at the end of the month, 7-day government bond repurchasing was quoted at 5%, with small banks aggressively receiving capital and large banks suspending loans, which weighed on domestic financial markets. Technically market is under long liquidation as market has witnessed drop in open interest by -0.47% to settled at 12088 while prices down -4.3 rupee, now Nickel is getting support at 808.260 and below same could see a test of 804.50 level, And resistance is now likely to be seen at 817.860, a move above could see prices testing 823.70.

Nickel yesterday settled down -0.53% at 812 as the Chinese government said it will audit government debt and assess debt risks of local governments this week, compounding worries over demand from the world's second largest economy. Latest data showed the Chinese economy has slowed down. However, anticipation that the US Federal Reserve will keep QE3 in place offset worries over demand in China. As a result, commodity prices bounced back from lows. However, sales of second-hand home in the US continued to drop in June, constraining the upside space of base metals prices. Base metals had little upward momentum after US shares fell back. The market was cautious before the US Federal Reserve announces its interest rate decision. Annualized US pending home sales in June was 10.9%, lower than both expectations and May, while monthly rate dropped by 0.4%, compared to a growth of 6.7% in May. That is because mortgage interest rates began to rise since May, which affected home sales in June, while contracts signed also decreased due to low inventories. Dallas Fed's manufacturing index for July recorded 11.4, much lower than 17.1 expected, and this weighed down US stocks. Due to tight liquidity at the end of the month, 7-day government bond repurchasing was quoted at 5%, with small banks aggressively receiving capital and large banks suspending loans, which weighed on domestic financial markets. Technically market is under long liquidation as market has witnessed drop in open interest by -0.47% to settled at 12088 while prices down -4.3 rupee, now Nickel is getting support at 808.260 and below same could see a test of 804.50 level, And resistance is now likely to be seen at 817.860, a move above could see prices testing 823.70.

Trading Ideas:

Nickel trading range for the day is 804.5-823.7.

Nickel settled weak as market was cautious before the US Federal Reserve announces its interest rate decision.

Chinese government announced to audit local debt, triggering concerns over local debt problems.

US GDP growth in 2Q expected is only 0.9%, hopes that the US Federal Reserve will maintain easing policies strengthened