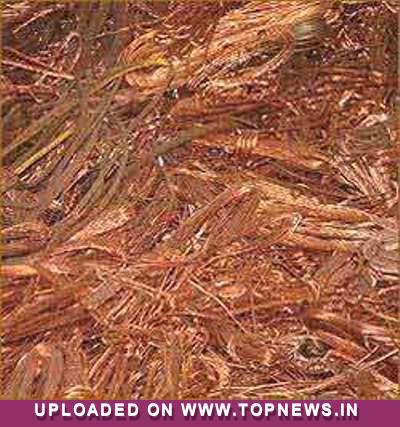

Commodity Trading Tips for Copper by KediaCommodity

Copper settled down -0.74% at 421.30 finished mostly lower on demand concerns after China’s consumer inflation grew less than expected last month and as US jobless claims rose unexpectedly to a two-month high last week. China's consumer inflation eased more than expected to a four-month low in August as food and consumer goods prices cooled, with markets shrugging off prospects that China's central bankers would act to shore up growth. An abrupt slowdown in China's credit growth as well as wobbles in Germany as a result of sanctions over the Ukraine crisis are threatening to derail global growth and casting a pall over metal demand. There are also worries that the United States may act to raise rates sooner than expected, drawing back cheap liquidity that has been cushioning industry as well as commodity investors, while also boosting the dollar. Adding to pressure on copper, the global refined copper market is seen flipping into a surplus of 405,000 tonnes this year, after four consecutive years of apparent deficit, as new mine supply outstrips demand. Meanwhile, confidence at big Japanese manufacturers turned positive in July-September and they expect business conditions to improve further in the following quarter, a government survey showed. Market players looked ahead to the release of key U.S. data later in the session for further indications on the strength of the economy and the future path of monetary policy. Technically market is under fresh selling as market has witnessed gain in open interest by 4.61% to settled at 10525 while prices down -3.15 rupee, now Copper is getting support at 417.9 and below same could see a test of 414.6 level, And resistance is now likely to be seen at 424.3, a move above could see prices testing 427.4.

Copper settled down -0.74% at 421.30 finished mostly lower on demand concerns after China’s consumer inflation grew less than expected last month and as US jobless claims rose unexpectedly to a two-month high last week. China's consumer inflation eased more than expected to a four-month low in August as food and consumer goods prices cooled, with markets shrugging off prospects that China's central bankers would act to shore up growth. An abrupt slowdown in China's credit growth as well as wobbles in Germany as a result of sanctions over the Ukraine crisis are threatening to derail global growth and casting a pall over metal demand. There are also worries that the United States may act to raise rates sooner than expected, drawing back cheap liquidity that has been cushioning industry as well as commodity investors, while also boosting the dollar. Adding to pressure on copper, the global refined copper market is seen flipping into a surplus of 405,000 tonnes this year, after four consecutive years of apparent deficit, as new mine supply outstrips demand. Meanwhile, confidence at big Japanese manufacturers turned positive in July-September and they expect business conditions to improve further in the following quarter, a government survey showed. Market players looked ahead to the release of key U.S. data later in the session for further indications on the strength of the economy and the future path of monetary policy. Technically market is under fresh selling as market has witnessed gain in open interest by 4.61% to settled at 10525 while prices down -3.15 rupee, now Copper is getting support at 417.9 and below same could see a test of 414.6 level, And resistance is now likely to be seen at 424.3, a move above could see prices testing 427.4.

Trading Ideas:

Copper trading range for the day is 414.6-427.4.

Copper tumbled after data showed that Chinese inflation in August slowed more than expected, underlining concerns over the economy.

Official data released showed that Chinese inflation for August slowed to 2.0% on-year from 2.3% in July.

The weaker than expected data sparked speculation policymakers in Beijing will have to introduce fresh stimulus.