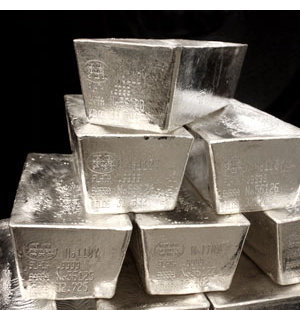

Commodity Outlook for Silver by Kedia Commodity

Silver dropped 3.9 percent to $27.66 an ounce and has fallen around 11 percent so far this month, putting it on track for its largest monthly decline since June 2009.

Silver dropped 3.9 percent to $27.66 an ounce and has fallen around 11 percent so far this month, putting it on track for its largest monthly decline since June 2009.

The prospect of tighter monetary policy in China, the top consumer of many industrial commodities, also hit the metal, which has a far greater industrial demand base than gold. Silver opening lower at 44250 with a quick rise to an intraday high of 44298 shortly after. Further declines in base metals and Crude saw silver decline as profit taking took the metal to an intraday low of 42753. Now technically market is trading in the range as RSI for 18days is currently indicating 40.82, where as 50DMA is at 44107.94 and silver is trading below the same and getting support at 42329 and below could see a test of 41768 level, And resistance is now likely to be seen at 43874, a move above could see prices testing 44858.

Trading Ideas:

Silver trading range is 41768-44858.

Silver dropped almost 4% for its biggest one-day decline in 1-1/2 months.

Silver looks to take support at 42660 level and resistance at 43080 level.

Silver came under pressure following another outflow of metal from top silver ETF iShares Silver Trust.

SILVER A JUMP TILL 43200 CAN BE SEEN BEFORE ANOTHER ROUND OF SELLING.