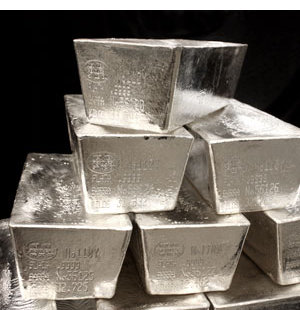

Commodity Outlook for Silver by Kedia Commodity

Silver opened at 24560 weaker USD, rallying base metals, crude oil and stronger equity markets inspired investors to buy the metal. It marched higher, climbing above 25000 per kg and also crossed first time $16.00 per ounce and pushed to a high of 25286.

Silver opened at 24560 weaker USD, rallying base metals, crude oil and stronger equity markets inspired investors to buy the metal. It marched higher, climbing above 25000 per kg and also crossed first time $16.00 per ounce and pushed to a high of 25286.

Light profit taking as the session unwound took the metal lower and later closed at 25198, now technically market is trading in the range as RSI for 18days is currently indicating 44.91, where as 50DMA is at 26559.08 and silver is trading below the same and getting support at 24743 and below could see a test of 24289 level, And resistance is now likely to be seen at 25469, a move above could see prices testing 25741.

Trading Ideas:

Silver trading range is 24289-25741.

Silver jumped more that 2% on weaker USD, rallying base metals, crude oil and stronger equity markets.

Silver manage to cross the 16$ mark that is above 200ma and on mcx crossed above 25000 mark.

Silver holding support 24740 and resistance will be likely to get at 25740 levels.

BUY SILVER MAR @ 25000-25060 SL 24922 TGT 25122-25190-25260.MCX (EVE WEAK)

SILVER $ FIX IS AT : 15.82 & CURRENTLY SILVER $ IS TRADING AT : 16.09 & DOWN BY -0.12%