Commodity Outlook for Copper by KediaCommodity

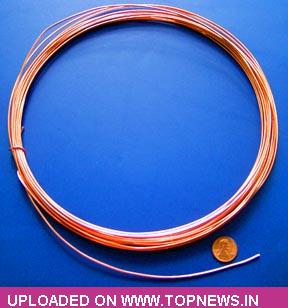

Copper fell from record high as investors worried about demand in China ahead of key trade data from the top metals consumer, offsetting bullish signs of market tightness. However, the copper market looked well supported amid growing concerns about market tightness. Supply shortages have been a major factor behind the surge in copper prices in recent months, due to a combination of falling ore grades, labour problems and project delays. A trend of falling LME inventories this year has fuelled supply concerns. On Wednesday, copper stocks slipped 800 tonnes to 349,450 tonnes, having fallen from 6-1/2 year highs at 555,075 tonnes hit in mid-February. For today market is looking for the support at 406.6, a break below could see a test of 403.8 and where as resistance is now likely to be seen at 413.8, a move above could see prices testing 418.2.

Copper fell from record high as investors worried about demand in China ahead of key trade data from the top metals consumer, offsetting bullish signs of market tightness. However, the copper market looked well supported amid growing concerns about market tightness. Supply shortages have been a major factor behind the surge in copper prices in recent months, due to a combination of falling ore grades, labour problems and project delays. A trend of falling LME inventories this year has fuelled supply concerns. On Wednesday, copper stocks slipped 800 tonnes to 349,450 tonnes, having fallen from 6-1/2 year highs at 555,075 tonnes hit in mid-February. For today market is looking for the support at 406.6, a break below could see a test of 403.8 and where as resistance is now likely to be seen at 413.8, a move above could see prices testing 418.2.

Trading Ideas:

Copper trading range is 403.8-418.2.

Copper fell from record high as investors worried about demand in China

Copper is taking resistance at 412.40 and support is seen at 406.60.

Copper daily stocks at Shanghai exchange came up by 3323 tonnes.