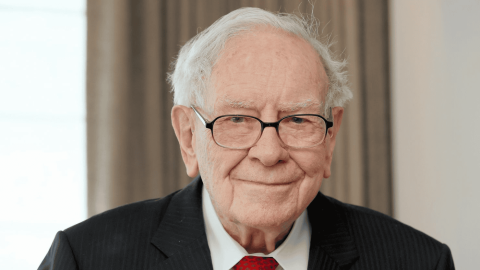

Warren Buffett to Step Down as CEO of Berkshire Hathaway by End of 2025

Warren Buffett, the legendary investor often referred to as the “Oracle of Omaha,” has announced his intention to step down as Chief Executive Officer of Berkshire Hathaway by the close of 2025. After an era-defining 55-year leadership stretch, Buffett leaves behind a $1 trillion conglomerate born from the ashes of a failed textile enterprise. This historic transition is neither sudden nor reactionary. Rather, it is the product of a strategically orchestrated, transparent succession plan that has been in development for over a decade. The torch is expected to pass to Greg Abel, a leader with deep operational expertise and philosophical alignment with Buffett’s long-term investment ethos.

The Blueprint Behind the Succession

Buffett’s exit plan wasn’t drawn on impulse. It was built on four pillars: early identification of future leaders, methodical mentorship, open shareholder communication, and a planned delegation of power. For years, Buffett has been candid about his succession roadmap, aiming to assure investors of business continuity in his eventual absence.

Leadership responsibilities will be divided, a shift from the long-standing concentration of power. This segmentation is designed to mitigate operational risks and maintain institutional stability in one of the world's most complex investment entities.

Greg Abel: The Heir to the Berkshire Throne

Greg Abel's rise is rooted in substance over showmanship. Born in Edmonton, Canada, Abel pursued accounting at the University of Alberta before beginning his career at PwC. His pivotal ascent came at MidAmerican Energy, where he transitioned from CFO to President, before it was absorbed into Berkshire Hathaway Energy.

Under Abel’s stewardship, the energy subsidiary now controls over Rs 7.5 lakh crore in assets. His promotion to Vice Chairman in 2018 placed him in charge of all non-insurance operations, encompassing railroads, industrials, and retail businesses—a portfolio reflective of Berkshire's vast diversification.

Buffett has publicly endorsed Abel without equivocation, declaring at the 2025 annual meeting that Abel will officially assume the CEO mantle by year-end. “Greg has the right temperament, experience, and respect from every manager inside Berkshire,” Buffett emphasized.

Ajit Jain and the Strategic Triumvirate

While Abel will helm the conglomerate, Ajit Jain remains central to Berkshire’s future. As Vice Chairman for insurance operations, Jain commands critical units like GEICO and Berkshire Hathaway Reinsurance, which serve as key liquidity engines for the group.

The succession framework divides power among three principal figures:

- Greg Abel – CEO: Oversight of operating businesses and capital deployment.

- Todd Combs and Ted Weschler – Investment Managers: Custodians of the stock portfolio, continuing Buffett’s conservative strategy.

- Board Chair (TBD): May be separated from the CEO to create checks and enhance governance.

This model promotes resilience through collaborative decision-making while preserving Berkshire’s decentralized DNA.

Market Reaction and Shareholder Sentiment

The investor community has largely welcomed the news with calm assurance. Shares of Berkshire Hathaway exhibited minimal volatility following the announcement—an endorsement of both Abel’s credibility and the strength of the succession blueprint. Buffett’s decision to hold onto his shares reaffirms his faith in the firm’s direction post-transition.

The Legacy of Munger and the Vacuum Left Behind

Buffett’s exit follows the recent passing of Charlie Munger, his vice chairman and philosophical counterpart. Munger’s minimalist yet profound influence helped mold Berkshire’s core principles. His absence deepens the need for a seamless leadership transition, as the company faces the dual challenge of replacing not just operational excellence, but intellectual legacy.

Why Abel Fits the Berkshire Mold

Abel’s tenure at Berkshire Hathaway Energy serves as a microcosm of his strategic alignment with Buffett’s values:

- Operational Mastery: Proven capacity to scale businesses while maintaining regulatory compliance and profitability.

- Global Acumen: Experience in navigating multinational operations across the U.S., U.K., and Asia.

- Cultural Assimilation: Two decades of living and breathing Berkshire’s decentralized structure and long-term orientation.

Unlike typical Wall Street executives, Abel doesn’t seek headlines. His reputation is built on execution, not flair.

Lessons for Corporate Succession Planning

Berkshire’s measured approach offers a gold standard for corporate transitions:

- Initiate planning well in advance.

- Foster internal leadership development.

- Maintain transparency with all stakeholders.

- Separate roles to manage complexity in large enterprises.

These principles could guide other legacy firms in avoiding leadership vacuums and governance crises.

The Challenges Awaiting Abel

While Abel is equipped with credentials and trust, he will lead without Buffett’s unparalleled brand equity. This means:

- Building relationships with investors and Wall Street analysts.

- Maintaining prudent capital allocation without the Oracle’s intuition.

- Facing contemporary challenges like ESG compliance, AI disruption, and macroeconomic volatility.

Buffett will remain connected in a non-executive capacity, but the strategic wheel now turns with Abel.

Media Reflections and Public Perception

Outlets such as Yahoo Finance, BBC News, Forbes, and Republic World have echoed Buffett’s confidence in Abel. The broader narrative is consistent: Berkshire’s succession model is exemplary in its clarity and foresight. The Independent and Fox Business praised the non-flamboyant competence of Abel, drawing a sharp contrast with celebrity CEOs elsewhere.

Future Strategy: The Berkshire Playbook Evolves

Warren Buffett’s departure signals the end of a legendary era in impressive investing with long term view. Yet it also signals a promising new chapter—led not by emulation, but by evolution. Greg Abel stands ready to honor Buffett’s legacy while steering Berkshire Hathaway through a generational inflection point. The blueprint is in place, the team is assembled, and the markets are watching.

Buffett built more than a company; he built a philosophy. It now falls on Abel to safeguard that doctrine—grounded in trust, discipline, and patience—as Berkshire charts its course through the complexities of 21st-century capitalism.