Trade Setup for 15 May; NSE Nifty 50 Eyes 25,000 levels, Nasdaq Bullish and Markets Rally on CPI Data

As expected from the analysis in the previous blog, Nifty was likely to take 24,600 as a strong support level due to a bullish candlestick pattern closing above it. As per the analysis, this played out as anticipated—Nifty formed a solid support at 24,600, and today it closed near 24,666, registering a gain of 88 points.

After a relatively flat opening, the market attempted an upward move in line with the ongoing trend. However, it faced selling pressure from the higher levels after a brief bounce and ended up closing with a gain of nearly 80 points. As of now, the market continues to follow the prevailing trend based on the latest analysis.

Global Market Analysis

Trump's Middle East Trip

Trump is visiting several countries in the Middle East. Yesterday, he met with Saudi Arabia's Crown Prince Mohammed bin Salman, and they discussed various important matters. A major announcement was made stating that Saudi Arabia plans to invest nearly $600 billion in the United States. This is a significant deal for both countries, especially as the U.S. is eager to attract more investment during the Trump administration’s tenure.

Trump also recently visited Syria, a country that, according to reports, underwent a coup against the previous government, which was backed by Russia. The newly formed government is reportedly supported by the United States. During his visit, Trump lifted the sanctions that were imposed on the former regime. A significant agreement was reached, and Trump stated that this is the time for Syria to demonstrate its potential and greatness following the removal of sanctions.

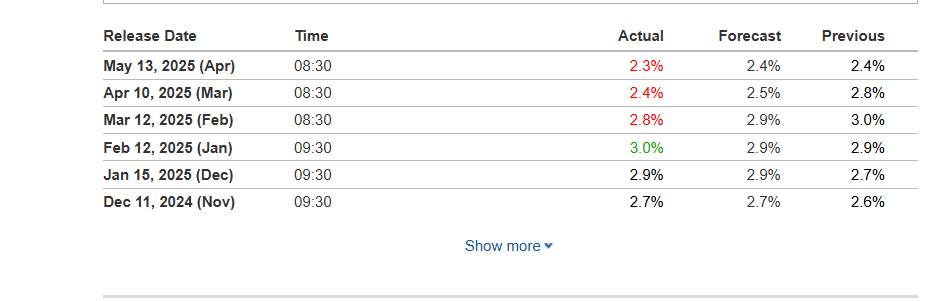

USA CPI Data

Yesterday, the United States released its Consumer Price Index (CPI) data, which came in significantly better than expected at 2.3%, compared to the forecast of 2.4%. This data is particularly important as it reflects the first month impacted by reciprocal tariffs. The lower-than-expected inflation figure boosted investor sentiment and fuelled the rally in the NASDAQ, which gained nearly 1.5% for the day.

NASDAQ on rise – 30 % RISE

The NASDAQ continues to surge higher, supported by several positive developments. There have been multiple foreign investments flowing into the U.S. economy, along with encouraging news about U.S.–China relations. Both countries have agreed to resume discussions on tariffs and are reportedly moving toward mutually beneficial trade deals. All of these factors are contributing to the positive momentum, pushing the NASDAQ to new highs.

In the previous month of April, when reciprocal tariffs were imposed globally, the NASDAQ has surged nearly 30% from that point until now. This is a positive development for both the American people and investors.

Domestic Market Analysis

Bofa Survey

Recently, Bofa released a survey on the Asian economy, bringing very positive news for India. According to the survey, India has emerged as a top investment destination in Asia, overtaking both China and Japan in investor preference. This shift is largely due to concerns over China's economic growth amid the ongoing U.S. tariff war, while India is seen as benefiting from the global trade realignment.

Additionally, domestic factors are contributing to this optimistic outlook. The Reserve Bank of India (RBI) has projected a GDP growth rate of 6.5%, and inflation figures have also come in lower than expected. Together, these favourable conditions are creating a strong and encouraging environment for the Indian economy.

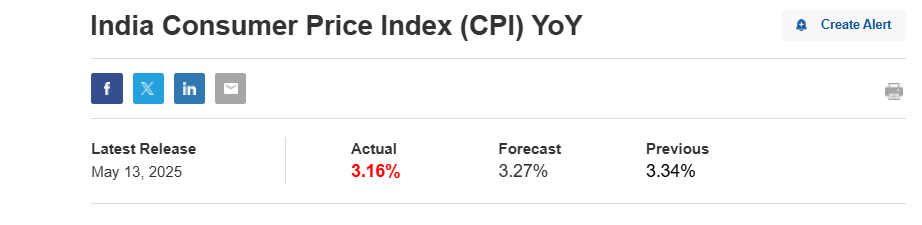

India CPI Data

The recent inflation data for April has been announced, and it has come in with a favorable result for traders. The inflation rate stands at 3.16%, compared to the forecasted 3.27%, which is a great outcome and has been well-received by the market. This indicates a reduction in concerns about the repo rate cut that is expected in the future. Such data strengthens the likelihood that the RBI will make further cuts in 2025.

Additionally, global certainty regarding tariffs is also contributing to a lower repo rate, fostering positive projections for the Indian economy. These factors are expected to play a significant role in the coming times.

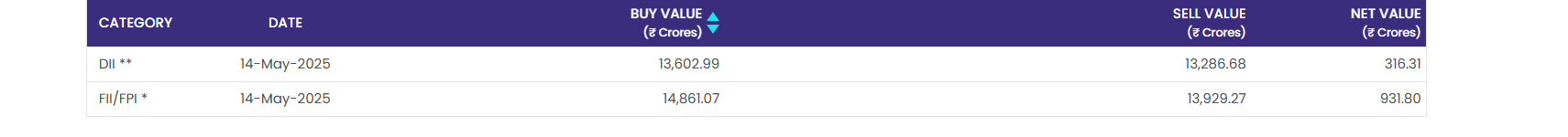

FII & DII ANALYSIS

The confidence of FIIs in the Indian equity market is surging, as evidenced by their recent activity. On May 14th, FIIs purchased nearly Rs. 931.80 crore in Indian equities, marking a consecutive buying trend in the Indian cash market. Similarly, DIIs supported the market with Rs. 316 crores.

In the previous days, on May 12th and 13th, they collectively bought around Rs. 4,273.80 crore. Both FIIs and DIIs are showing a positive response to the Indian cash market, which, along with favorable global cues, is contributing to the market's strength and upward movement.

NIFTY 50 prediction for tomorrow trade setup

The Nifty 50 is not reflecting as expected, despite having strong support from the trend established on May 12th. It showed solid support with a robust closing near its high, surpassing the 24,600 level. As long as the Nifty 50 does not close below the 24,600 level, we cannot confidently consider a bearish outlook.

The market is currently navigating with positive sentiment, fuelled by comprehensive and favourable news. In our previous blog, we mentioned that the 24,600 level is a strong support, and this has been confirmed by a solid closing near the high on May 12th. However, in today's trade setup for the Nifty 50 on the daily timeframe, a doji candle has formed, signalling a potential reversal.

However, it doesn’t appear to be as bearish as it seems, since the closing of the candle was quite precise. Until the Nifty closes below the 24,600 level, we cannot be confident that a correction is imminent. Therefore, we need to wait for a confirmed close below this level. On the upside, 25,000 is a strong resistance for the near term. This level will be key for the Nifty 50 in the near-term technical analysis.

Conclusion

FIIs are positive, and with Trump making progress on peace deals globally, investments in the US are increasing, which will help strengthen their economy. This, in turn, will have a positive impact on Nifty Pharma and Nifty IT stocks. While this is encouraging, we should continue to monitor the market.

As long as FIIs are not selling aggressively (indicated by a red closing), the market is likely to continue pushing higher. In the near term, the key levels to watch are 24,600 as support and 25,000 as resistance. Looking ahead, the trade deal with the USA will play a crucial role in the market's direction over the next six months.