Trade Setup for 05 June: NSE Nifty Eyes 25000 Levels, China Curbs Rare Earth Exports; FIIs, DIIs Turn Buyers

The market is moving sideways and not choosing any particular direction due to muted global cues this week and a key technical analysis zone. Both factors are working simultaneously, resulting in a flat movement throughout the day. Nifty closed at around 24,620, registering a gain of nearly 77 points.

Nifty has recorded one of the narrowest sideways movements in the past couple of months, with a low of around 24,530 and a high of 24,644—resulting in an intraday range of less than 150 points.

Global Market Analysis

Trump to speak with Xi soon Xi Jinping is scheduled to speak with Donald Trump soon, and this is being seen as a positive step toward trade negotiations. Trump has referred to Xi as a very good friend, but he also acknowledged that reaching a deal remains challenging. This makes the situation quite complicated for both countries to come to a positive resolution. All eyes are on how the conversation will unfold, especially regarding tariff negotiations and how critically they will influence the outcome. Since China is a major trading partner of the U.S., the conclusion of this meeting is expected to have a significant impact on Wall Street traders.

Iran's Supreme Leader on the Nuclear Deal

Recent developments have emerged regarding the ongoing negotiations between the U.S. and Iran over the nuclear deal. However, Iran is not taking the progressive steps the U.S. expects. The U.S. wants Iran to halt its uranium enrichment activities to prevent further development of nuclear weapons, but this demand is not being met.

Iran’s Supreme Leader has clearly stated that they will not comply with such conditions. This stance was somewhat expected, as stepping back would negatively impact Iran’s budget, especially after significant investment—both financially and politically—by the country's leadership in advancing its nuclear program.

Now, the key point to watch is that if things don’t go as per the expectations of the Trump administration, they may take action against it. How they choose to respond will be closely watched.

Domestic Market Analysis

India-USA Trade Deal Conclusion Reports are emerging that the U.S. and India are very close to finalizing a trade deal, with discussions nearing their conclusion. U.S. Secretary of Commerce, Luke Nick, stated that both sides are “not too far” from reaching an agreement—marking a positive step forward. If the deal is finalized, it would be a significant development in bilateral trade relations.

However, the U.S. has also expressed concerns regarding India’s purchase of Russian weapons and its involvement in BRICS. These factors may still play a role in shaping the final terms of the agreement.

If the deal is finalized on time, it could have a very significant impact on the stock market. Certain stocks, which have been moving sideways due to ongoing tensions, may finally see upward movement.

China Restricts Rare Earth Exports

A major development has emerged as China moves to tighten regulations on the export of rare earth minerals. This step could have a negative impact on the global auto sector, particularly the electric vehicle (EV) segment, which relies heavily on rare earth materials—most of which are supplied by China. Currently, China accounts for nearly 90% of the world’s rare earth production, giving it significant control over global supply.

Given the lack of viable alternatives in the short term, this move could put pressure on EV manufacturers. However, Maruti Suzuki has stated that this development is unlikely to have any immediate impact on their EV plans.

FII and DII Data Analysis

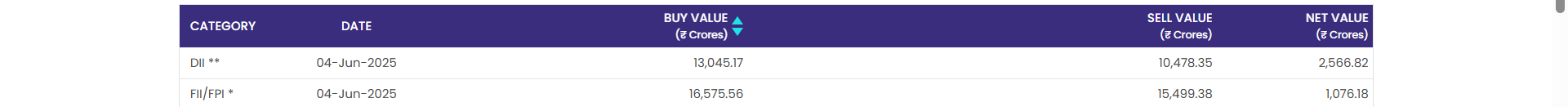

Today’s positive sentiment in the equity market, with Nifty gaining over 70 points, appears to be supported by both FIIs and DIIs. Foreign Institutional Investors (FIIs) turned net buyers after three consecutive sessions of selling, investing Rs. 1,076 crore in the Indian equity market.

At the same time, Domestic Institutional Investors (DIIs) also showed strong confidence, with net purchases worth Rs. 2,566 crore. The combined buying activity from both FIIs and DIIs contributed to the market’s upward movement today.

If buying from the FIIs sustains for 3–4 trading sessions, it will be very crucial, as it would boost the confidence of both FIIs and retail traders. This could create strong support at the 24,600 level and potentially push the Nifty 50 even higher, beyond the 25,000 level.

NIFTY-50 Technical Analysis Outlook

We have mentioned that the 24,462 level will be a strong support because of the swing low formed there. At the same time, it seems that NIFTY is attempting to make a higher move. If buying from the FIIs—which today was nearly over Rs. 1,000 crore—continues sustainably in the coming trades, especially in the FII bank segment, it could have a positive impact.

If we consider the Nifty levels, 24,500 will act as strong support, while 24,908 is a nearby good target for the next couple of trading sessions.

Conclusion

A sideways movement is underway, and we have been trading around the same levels for a week due to muted reactions from the major sectors. However, no definitive conclusion can be drawn yet, as the absence of a trade deal announcement is limiting significant movement in the Nifty 50. The market is showing a muted response, which is likely to continue in the coming days unless positive sentiment emerges.

Today’s FII buying activity is encouraging, and if FII purchases exceed Rs. 2,000 crore, it would provide strong support for the Nifty 50 to reach higher levels. Conversely, if buying remains below that threshold, we can expect the market to continue its muted performance.