Tata Steel Share Price Manages to Close Above Rs 150 Amid Bearish Market Sentiment

Tata Steel shares opened at Rs 151.56 and touched an intraday high at Rs 154.24 but the stock drifted lower towards the end of the trading session. Tata Steel still managed to close above Rs 150. Tata Steel has witnessed a strong rally from yearly lows at Rs 122 and the stock is still looking bullish on technical charts. If market conditions improve, we can expect further momentum in Tata Steel and other steel sector stocks.

Company Overview

Tata Steel's Market Position

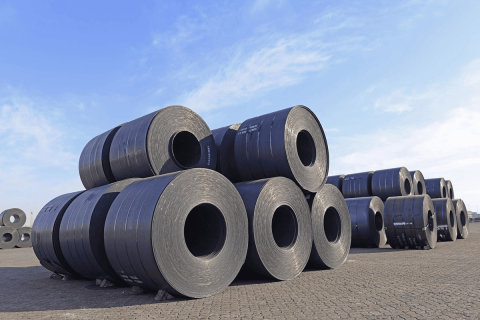

Established in 1907, Tata Steel has cemented its position as a leading steel manufacturer, serving sectors such as automotive, construction, and consumer goods. Its extensive product portfolio and global presence underscore its significance in the steel industry.

Recent Stock Performance

Price Movements and Market Capitalization

As of the latest trading session, Tata Steel opened at ₹151.56, reached a high of ₹154.24, and dipped to a low of ₹150.41, closing at ₹150.95. The company’s market capitalization stands at ₹1.88 trillion, reflecting its substantial presence in the financial sector.

Technical Analysis

Candlestick Patterns

An examination of Tata Steel’s daily candlestick charts reveals the formation of a 'Doji' pattern in recent sessions, characterized by opening and closing prices that are virtually identical. This pattern often signifies market indecision and can precede significant price movements, depending on subsequent trading activity.

Fibonacci Retracement Levels

Applying Fibonacci retracement analysis from the 52-week low of ₹122.62 to the high of ₹184.60, key levels emerge:

| Retracement Level | Price (₹) |

|---|---|

| 23.6% | ₹169.55 |

| 38.2% | ₹158.91 |

| 50.0% | ₹153.61 |

| 61.8% | ₹148.31 |

| 100% | ₹122.62 |

The stock’s current position near the 61.8% retracement level suggests potential support, with resistance likely near ₹158.91.

Support and Resistance Levels

Identifying critical support and resistance levels is essential for strategic trading:

| Level | Price (₹) |

|---|---|

| Support 1 | ₹148.00 |

| Support 2 | ₹140.00 |

| Resistance 1 | ₹155.00 |

| Resistance 2 | ₹160.00 |

The immediate support at ₹148.00 aligns closely with recent lows, while resistance at ₹155.00 corresponds with recent highs, indicating consolidation within this range.

Investment Insights

Strategic Considerations

Given the technical indicators and analyst forecasts, investors should approach Tata Steel with caution. The 'Doji' candlestick pattern suggests market indecision, and the proximity to key support levels necessitates vigilant monitoring. A breach below ₹148.00 could signal further downside, while surpassing ₹155.00 may indicate bullish momentum.

Bottomline for Investors and Traders

Tata Steel’s strategic role in India’s steel industry positions it as a significant entity in the financial markets. However, current technical indicators and mixed analyst forecasts advise a cautious investment approach. Investors are encouraged to conduct thorough due diligence and consider market volatility when making investment decisions.