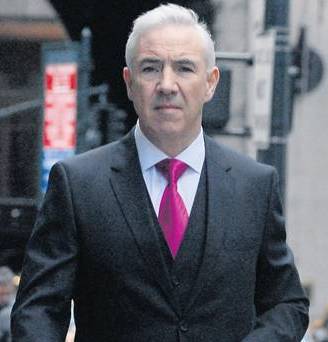

Sean Dunne files for bankruptcy in the US

Property developer Sean Dunne has filed for bankruptcy in the US and there are indications that he might be let off from paying back to his lenders in just months.

Property developer Sean Dunne has filed for bankruptcy in the US and there are indications that he might be let off from paying back to his lenders in just months.

Mr Dunne filed for bankruptcy claiming that he is being forced to go in for bankruptcy by the financial institutions, who are claiming their dues from the developer. He raised debt worth hundreds of millions of dollars for making property investments. Some believe that he might be let off from paying back his debt in just months.

On the other hand, if his lenders contest the bankruptcy petition, the issue could be come a long legal battle between the developer and his lenders. Mr. Dunne has filed a Chapter 7 petition in Connecticut in the US. Mr Dunne has said that he has estimated liabilities of between $500 million and $1 billion and assets of between $1 million and $10 million.

Mr Dunne reportedly filed for bankruptcy after completing an online credit counselling course, a few hours before the court recorded his application on Friday. Credit counselling is mandatory under the for bankruptcy applications in the country. Mr. Dunne is the second Irish business major to file for bankruptcy in the US following a similar move by former chief executive of Anglo Irish Bank, David Drumm in Massachusetts in 2010.