RBI cuts CRR, leaves repo rates unchanged

As had been expected, the Reserve Bank of India (RBI) on Tuesday slashed cash reserve ratio (CRR) by 25 basis points to 4.25 per cent, but discouraged the Indian market by leaving repo rates unchanged.

As had been expected, the Reserve Bank of India (RBI) on Tuesday slashed cash reserve ratio (CRR) by 25 basis points to 4.25 per cent, but discouraged the Indian market by leaving repo rates unchanged.

The central bank left repo rate unchanged citing high rate of inflation. In its half-yearly monetary policy review, the central bank also lowered its forecast for gross domestic product (GDP) from 6.5 per cent to 5.8 per cent for fiscal year of 2012-13.

The announced cut in CRR will free up additional Rs 17,500 crore into the economy. The RBI also hinted that there was a possibility of rate cut in the fourth quarter of running fiscal.

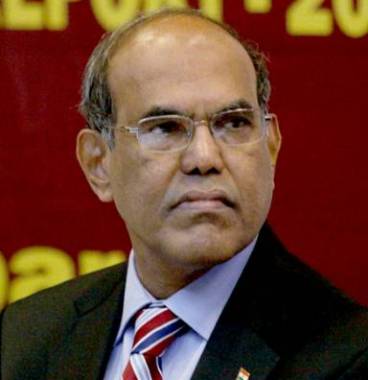

Speaking to media persons, RBI Governor Duvvuri Subbarao, said that they anticipated inflation would go up in the coming few months before starting to decline in the fourth quarter.

Speaking on the topic, he added, "Assuming inflation pans out as we have projected; there is scope for further easing in the fourth quarter."

He also said that the level of NPA wasn't alarming but admitted that it was certainly somewhat disturbing. The central bank hiked provisions from 2 per cent to 2.75 per cent as an interim measure. If growth dips and people don't pay, then banks would have to absorb the shock.

After the announcement of monetary policy review, the Indian market dropped more than 1 per cent on Tuesday.