Trade Setup for 08 May; Operation Sindoor, Fed Meeting Outcome Today and Nifty 24600 level

The consecutive analysis over the past three days has been as accurate as the movement of the Nifty-50 itself. As previously discussed, Nifty was expected to take support near the 24,350 level—and that’s exactly what happened.

Today, the market moved lower due to strikes occurring in several areas of Pakistan. Although Nifty dropped initially, it quickly recovered the same ground. Throughout the day, Nifty moved within a sideways zone but did not close below the key 24,350 level we had identified. This reaffirms that our analytical perspective is on point.

Additionally, today’s trade setup did not show a significant upward move or a strong close, which we had also anticipated. Notably, Nifty formed a hammer-like long-spike candlestick pattern on 02 may trade setup. This formation is likely to act as a hurdle for Nifty-50 in the near future and is unlikely to be crossed anytime soon.

Global Market Analysis

Fed Meeting Outcome Today

The Fed is expected to pause rate cuts in today’s meeting. However, pressure is mounting from the U.S. administration, and discussions around this are playing a key role. The main question is whether Fed members and Jerome Powell will act independently or yield to political pressure.

Their decision will depend on how they interpret market sentiment and inflation trends. This outcome will play a crucial role, and today’s Fed decision is likely to significantly impact tomorrow’s movement in the Indian IT sector and the NASDAQ.

U.S. March Trade Deficit Data

In an effort to reduce the trade deficit with the global economy, the Trump administration attempted to apply pressure by increasing tariffs worldwide. The administration believed this would reduce the country's imports.

However, the recent data for March shows that the U.S. recorded a trade deficit at a near all-time high, widening to nearly $140 billion.

Now, this situation has emerged in the pre-tariff phase, as the U.S. has imposed tariffs on 02 April. The upcoming data following these tariffs will be highly significant because the trade deficit is at the center of why the tariff war is happening. Closely monitoring this data is becoming increasingly important.

If the 10% tariff shows a positive impact on reducing the trade deficit for U.S. companies, it will boost confidence within the Trump administration. This could lead them to implement even more aggressive tariff hikes on global trade.

It’s also crucial to monitor how such tariff hikes will affect U.S. economic growth, as the outcome could present both pressure and potential rewards for the administration.

Domestic Market Analysis

Operation Sindoor

On 7th May, India carried out strikes on multiple locations in Pakistan, targeting areas where terrorists were believed to be trained and residing with the intent to attack Indian territory. These strikes, conducted in the early morning hours, focused on several key spots identified as strategic terrorist hubs.

With full domestic support from all major political parties, the strike was carried out without internal resistance. According to various sources, around 70 terrorists were killed in the operation, along with 10 family members of Jaish-e Mohammad, an organization led by Masood azhar. This was considered a significant achievement for India.

Following the strike, India has paused further action. However, if there is any retaliation from the other side, it could lead to further escalation. Such developments will be crucial to watch, as any military response may negatively impact market sentiment and influence upcoming trade setups.

India–UK Seal Free Trade Agreement

The India–UK Free Trade Agreement has now become a reality. The UK will offer zero-duty tariffs on 99% of Indian exports, while India will also reduce tariffs on certain UK imports.

This development is expected to significantly impact several sectors, particularly the auto sector. TVS Motors has stated that it stands to benefit from the deal, and the overall auto industry is expected to see positive effects. Reflecting this sentiment, Tata Motors' stock jumped nearly 4% today, indicating the market’s favourable response to the agreement.

Amid the India–UK Free Trade Agreement, Finance Minister Nirmala Sitharaman also hinted at progress in the trade agreement discussions with the European Union. She stated that many key issues have been resolved, with only two to three items remaining to be finalized. A deadline has been set for the end of December, by which India and the European Union are most likely to sign the agreement.

This development would be a positive step for both regions, especially Europe, as it would establish a strong free trade framework and create greater opportunities for Indian businesses in the European market.

FII and DII Activity Analysis

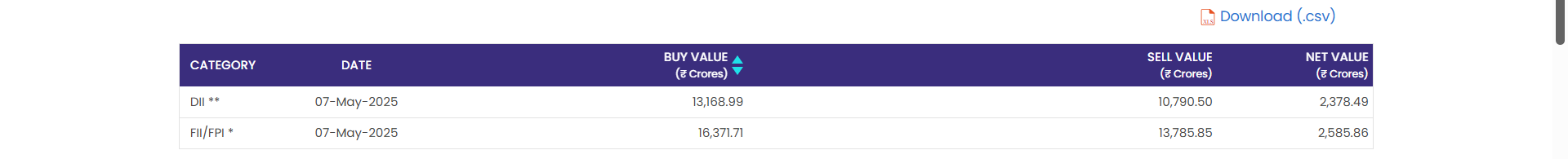

Foreign Institutional Investors (FIIs) have not taken any significant steps in response to the ongoing India–Pakistan conflict. They appear to be deliberately avoiding reacting to the situation, as seen in previous trade setups. However, on 7th May, FIIs turned net buyers, investing ₹2,585 crore in the Indian stock market. Similarly, Domestic Institutional Investors (DIIs) were also net buyers, with an inflow of ₹2,378 crore.

This data suggests that both FIIs and DIIs are not factoring in any major escalation between India and Pakistan at this point. This is important because significant market downturns usually coincide with large-scale FII selling. Historically, FIIs have played a key role in triggering major falls in the Nifty 50 during times of geopolitical tension.

Nifty 50 Outlook for Tomorrow's Trade Setup

Nifty50 is on the verge of a short-term reaction based on technical factors rather than ongoing geopolitical conflicts. With the support from FIIs and DIIs amid the current situation, Nifty50 is showing sustainable movement and is attempting to move upward in the near future, creating a favourable setup for future gains.

Additionally, the India-UK trade deal has been concluded, and the UK's response has been received. Tensions might rise today if any bold decisions are made by top commanders, following the escalation between India and Pakistan and Operation Sindoor.

However, these developments have not occurred yet. Currently, Nifty50 appears to have an open outlook with favourable levels for further movement. If we take a deeper look, there are promising levels for the upcoming trade setup.

If we look more closely, we see that the 24,600 level is acting as a resistance for now. The support, however, is not at 24,300-24,350, as we have observed that once this level was crossed and a lower opening occurred, the reliability of that level became weaker. Therefore, for now, the support stands at the 24,200 range. As mentioned in the previous trade setup, the resistance remains at 24,600.

Conclusion

The key focus among India’s adversaries is how India will respond to the Pahalgam attacks and what military action it will take. In the early morning of May 7th, the Indian Army conducted an operation and later held a press conference providing a detailed explanation of the mission—highlighting the precision of the attack. The operation specifically targeted terrorist camps, avoiding civilian areas and military bases, indicating India’s intent to avoid further escalation.

The critical question now is how Pakistan will respond. Several sources suggest that Pakistan may not retaliate, but if they do, it could be through limited actions such as symbolic open firing to appease public sentiment and show strength domestically.

If any action is taken against innocent civilians, the people of Kashmir, or the Indian military, it could significantly impact the stock market.