Mahindra & Mahindra Share Price Jumps 2%; Prabhudas Lilladher Suggests BUY with Target Price at Rs 3,456

Mahindra & Mahindra (M&M), one of India's leading automotive companies, has received a Buy recommendation from Prabhudas Lilladher with a target price of Rs 3,456, implying significant upside potential from its current market price of Rs 2,899. The company's focus on electric vehicle (EV) innovation, robust financials, and strategic capacity expansion make it an attractive investment for both retail and institutional investors.

Summary of the Research Report

Prabhudas Lilladher's analysis highlights M&M's transition to the EV segment through its INGLO platform, positioning it as a frontrunner in India's burgeoning EV market. The introduction of BEVs (Battery Electric Vehicles), BE 6e and XEV 9e, backed by competitive pricing and high-end features, is expected to significantly boost the company’s market share. With an impressive pipeline of innovations and substantial capacity expansion, M&M aims to deliver long-term value to its stakeholders.

Competitive Pricing and EV Aspirations

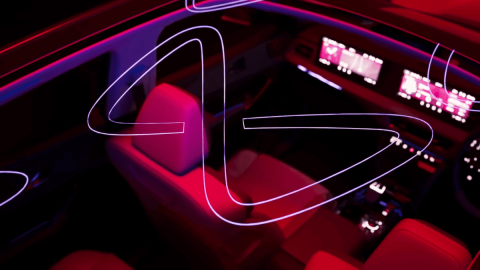

Introduction of BEVs: M&M unveiled its new BEV models, BE 6e and XEV 9e, with battery capacities ranging between 59kWh and 79kWh, offering driving ranges up to 682 km. These vehicles boast premium features, such as ADAS technology, extensive storage space, and interactive instrument clusters.

Pricing Strategy: The introductory prices for these BEVs start at Rs 18.9 lakh for the BE 6e and Rs 21.9 lakh for the XEV 9e. This pricing undercuts competitors and sets a strong foundation for market penetration.

Market Outlook: With a growing EV portfolio and improved monthly production capacity, M&M is projected to sell 2,700 units per month by FY26 and 5,300 units per month by FY27, capturing an estimated 9.3% penetration in the UV market by FY27.

Investment and Expansion Plans

Capacity Expansion: M&M plans to increase its production capacity from 54,000 units/month to 64,000 units/month by FY25, focusing on BEVs. This aligns with the company’s target to enhance its EV manufacturing footprint.

Strategic Investment: With a robust investment plan of Rs 120 billion over FY24-FY27, M&M is channeling Rs 45 billion towards new product launches and BEV capacity building.

Financial Performance and Valuation

Strong Financial Metrics: M&M's financial results indicate healthy growth. For FY24, the company reported:

Sales: Rs 988 billion

EBITDA: Rs 127 billion (EBITDA margin: 12.8%)

PAT: Rs 107 billion

EPS: Rs 89.4

Future Estimates: By FY27, M&M is expected to achieve:

Sales: Rs 1,483 billion

EBITDA: Rs 220 billion (EBITDA margin: 14.8%)

EPS: Rs 131.3

Technical Analysis

Resistance and Support Levels:

| Level | Price (Rs) |

|---|---|

| Support 1 | 2,800 |

| Support 2 | 2,650 |

| Resistance 1 | 3,050 |

| Resistance 2 | 3,250 |

Candlestick Patterns: On the daily charts, M&M shows a bullish engulfing pattern, indicating strong buyer interest around current levels.

Fibonacci Analysis: Key retracement levels based on the recent high of Rs 3,222 and low of Rs 1,542:

| Retracement Level | Price (Rs) |

|---|---|

| 23.6% | 2,650 |

| 38.2% | 2,850 |

| 50.0% | 2,960 |

| 61.8% | 3,070 |

Comparison with Competitors

Maruti Suzuki: As a market leader in passenger vehicles, Maruti Suzuki is gradually entering the EV segment. However, its focus remains on hybrid technology, contrasting with M&M's full-electric portfolio.

Hero MotoCorp: With its foray into EVs through the Vida brand, Hero MotoCorp poses competition in the two-wheeler EV market but lags behind M&M in the passenger vehicle segment.

Conclusion and Recommendation

M&M's strategic initiatives in the EV space, supported by competitive pricing, innovative platforms, and robust financial health, position it as a compelling investment opportunity. Prabhudas Lilladher's target price of Rs 3,456 reflects confidence in the company's growth trajectory. Investors are advised to accumulate the stock at current levels for long-term gains, while monitoring key support and resistance levels for tactical trades.

Disclaimer: Investors are encouraged to conduct their due diligence or consult a financial advisor before making investment decisions.