RBI refuses to intervene to boost foreign exchange reserves

The Reserve Bank of India (RBI) has refused to intervene in the currency market to arrest the rupee's decline even as imports are falling to 90s levels.

The Reserve Bank of India (RBI) has refused to intervene in the currency market to arrest the rupee's decline even as imports are falling to 90s levels.

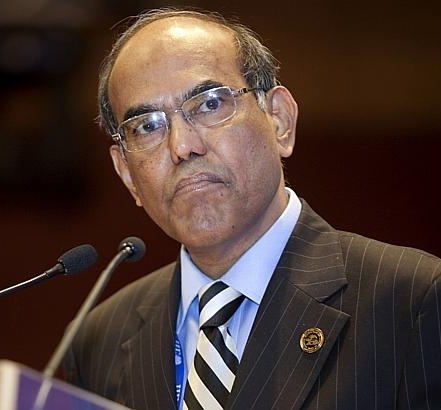

RBI Governor Duvvuri Subbarao said that the central bank would not purchase US dollars from the currency market to provide a boost to the foreign exchange reserves even as the coverage of imports as well as external debt has slipped to multi-year lows. He said the rupee should find a level based on demand & supply regardless of the size of the cover.

Declaring the central bank's stance, Subbarao said, "On whether we will intervene to increase the foreign exchange reserves, the answer is no."

He added that it would not be appropriate for the central bank to intervene in the market just to boost foreign exchange reserves as self insurance.

A few months back, the Indian currency dropped 6.8 per cent putting it among the worst performing currencies in Asia, prompting economists to suggest that there was a need to need to boost Forex reserves. In June, it touched its record low of Rs 57.32.

After depreciating 9.3 per cent in June quarter, the Indian currency slipped 4.8 per cent to the greenback in the September quarter. Currently, the rupee is swinging between Rs 51 to Rs 54 to the US dollar.

The RBI also suggested that the government must balance its books by slashing spending as this is the single way to realize the goal of achieving a sustained fiscal consolidation.