Mazagon Dock Shipyard Business Model; Revenue, Expenses and Future Perspective

Mazagon Dock Shipbuilding Limited is a company with a core focus on shipyard construction. It initially began with building small dry docks and gradually developed a strong portfolio in the sector, becoming one of the major players in shipbuilding from an Indian perspective. In the financial year 2024, the company recorded one of the highest revenues in the sector, exceeding ₹11,000 crore, with a profit of around ₹1,937 crore.

In 1774, the company began constructing dry docks. Later, in 1934, it was incorporated as a private company. By 2006, it had received Mini Ratna status. Over the years, it achieved several significant milestones—for instance, in 1998, it received ISO certification for shipbuilding. More recently, in 2015, it was awarded a contract by the Ministry of Defence to construct and deliver four frigates.

It has also recently delivered the fifth Scorpene submarine, Vagir, and a guided missile destroyer to the Indian Navy. Additionally, it has finalized a Memorandum of Understanding (MoU) for the indigenous development and manufacturing of ship and submarine equipment in collaboration with both national and international firms.

How does Mazagon Shipyard Earns Revenue

The main business of the company comes from two highly prospective areas: shipbuilding and ship repair. In the shipbuilding segment, the company signs contracts for constructing ships and delivers them accordingly. Several ongoing and completed projects highlight its capabilities, including submarines like INS Kalvari, INS Khanderi, INS Karanj, INS Vela, and INS Vagir, all of which have been delivered to the Indian government and commissioned into the Indian Navy. These projects reflect the company's accountability and strengthen its reputation, positioning it well to secure more significant projects in the future.

The company manufactures sophisticated submarines, vessels, and related equipment on a contract basis, which forms the core of its revenue. One notable aspect is the company’s extensive experience in the field, along with significant investment in innovation across its business operations.

This plays a crucial role in strengthening its position, especially in the shipbuilding and defense sectors, where testing and reliability are key. While the company builds these products, what truly stands out is the attention to detail and quality during the commissioning phase. Several projects have been successfully completed by Mazagon Dock Shipbuilders, earning strong recognition and brand credibility.

It receives contracts from the Indian government and other relevant agencies, and then outsources certain tasks to its vendors on a contract basis.

It maintains strong relationships with these vendors, ensuring smooth operations and a reliable supply chain. This approach not only streamlines the production process but also supports domestic vendors and small businesses, contributing positively to the country's industrial ecosystem.

How the expense occurs in Mazagon

Since most of the company's revenue comes from the shipbuilding business, we can clearly define that the majority of its expenses are related to the cost of materials consumed, which currently stands at ₹5,081 crore. In addition, the procurement of base and depot space accounts for ₹1,145 crore in expenses, and employee benefit expenses amount to ₹897 crore.

However, employee benefit expenses may remain relatively stable, as the company already has a sufficient workforce. Therefore, with more contracts in the future, the company is likely to achieve higher stable operating margins on upcoming projects.

Company role in Make in India

Mazagon Shipyard’s business plays a vital role in supporting India’s growth, especially in critical sectors like defense and shipbuilding, which are essential for national security. These sectors hold strategic importance for any country. During times of conflict between nations, there is an urgent need to strengthen defense capabilities by accelerating the production of such equipment.

Therefore, it becomes extremely important for companies in this space to reduce dependency on external sources. This helps in building a robust supply chain, ensuring faster production and timely delivery of defense products to clients.

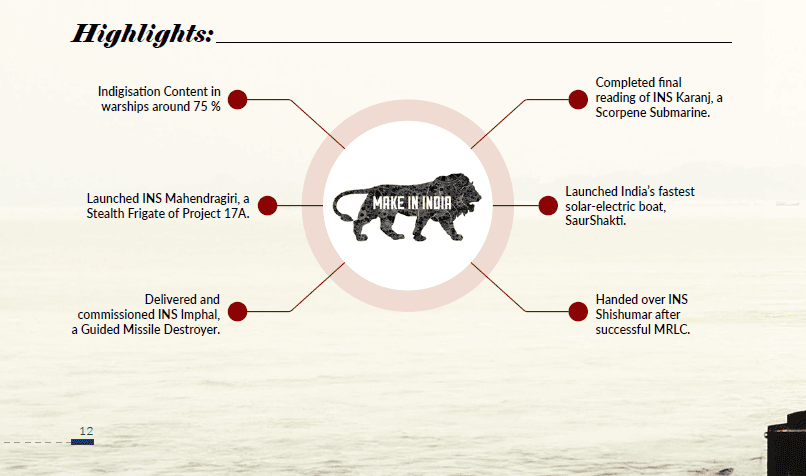

In this context, Mazagon Shipyard has a promising outlook, as approximately 75% of its warship components are indigenously sourced. This high level of indigenous content is a significant advantage. In times of war or conflict, having a strong domestic supply chain becomes crucial, and this capability greatly enhances the company’s reliability.

Moreover, the company is actively working to increase the indigenous content in its upcoming projects, aligning with the vision of Atmanirbhar Bharat (self-reliant India)."

The company has established a dedicated 'Make in India' department to manufacture products independently.

Future Outlook for the Company

The future outlook for Mazagon Shipyard appears strong, as it continues to expand its client base beyond India. The company has secured business from Danish clients for the delivery of six 7,500 DWT multipurpose hybrid vessels. Additionally, it has received orders from the Nepali Army for the maintenance and repair of MI-17 helicopters.

Furthermore, Mazagon Shipyard is also receiving contracts from the U.S. government through the NAVSUP Fleet Logistics Centre to carry out voyage repairs on U.S. Navy vessels. These developments reflect the company’s growing global presence and diversified revenue streams, indicating a positive growth trajectory.

The company also has a strong order book, which has reached approximately ₹38,560 crore—a very significant figure. This includes key projects such as the P-15B Destroyers, P-17A stealth Frigates, and P-75 Kalvari-class Submarines.

The company has also invested a significant amount of money in research and development. In the fiscal year 2023-24, the company invested approximately 5.26% of its PAT in R&D. This is a major and key aspect for the company. If the company continues to invest in research, implement new innovations, and ensure quality assurance and cost efficiency, it will gain a strong competitive edge both domestically and internationally.

Obstacles for the Company’s Business

The company faces challenges from both the Ministry of Defense and international markets. If India, as a country, does not receive strong assurances from other South Asian nations or fails to establish effective MOUs, it will become increasingly difficult to expand business internationally. This remains a hurdle unless the company significantly strengthens its portfolio.

In the domestic market, the company faces strong competition from well-established players such as GRSE and Cochin Shipyard (COSINSIPIAT), both of which are public sector companies with a solid presence in this sector. Similarly, in the international market, companies from Japan, China, and South Korea also have a strong foothold in this industry.

If the company fails to innovate and merely offers similar products to what competitors provide, it may lose its competitive edge, and its growth may not meet expectations. However, if the company introduces meaningful innovations, strengthens its business model, and ensures quality assurance along with cost efficiency, it could significantly benefit the company in the times ahead.