Indian rupee rose to 52.25/26 against US dolalr

The Indian rupee has risen to the level of 52.25/26 against the US dollar on Tuesday due to new momentum in by foreign funds.

The Indian rupee has risen to the level of 52.25/26 against the US dollar on Tuesday due to new momentum in by foreign funds.

The foreign funds acquired government debt before limits on the amount of bonds expire in the middle of the month. According to foreign exchange traders, the rise of the rupee was further boosted by a more than 1.5 percent rise in Indian stock market.

The partially convertible Indian rupee was at 52.25/26 against the dollar, almost at the level of 52.24, which was recorded on last December 16. Investors are not shying away from selling dollars at the moment due to the increases risk appetite in the market.

Foreign exchange traders believe that the rupee could touch 51.50 in the next few sessions as foreign funds are increasingly looking at government debt hoping that the RBI will soon start lowering interest rates to boost economic growth in the country.

The rates fell 17 basis points in December, which is the highest fall since May 2010. The Reserve Bank of India (RBI) has increased its key benchmark interest rates 13 times since March 2010 in order to control inflation in the country. According to analysts, the investors are expecting a reversal in the cycle of interest rate changes and this is affecting yields of the Indian bonds.

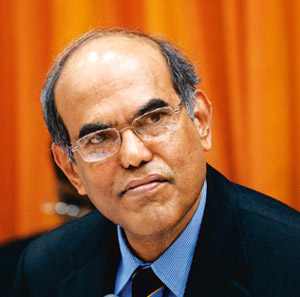

The RBI governor D Subbarao has already indicated that the central bank is considering a reversal of the monetary policy as the inflation is falling and the high interest rates have affected economic growth in the country.