HDFC RD Interest Rates 2025: Big Changes You Need to Know!

HDFC Bank has revised its recurring deposit (RD) interest rates for 2025, making it an attractive option for investors seeking stable and predictable returns. These updates benefit both regular customers and senior citizens by offering competitive rates, ensuring that small, consistent savings grow effectively over time. If you're interested in maximizing your returns, you may find this Exness Go guide useful for additional investment insights.

This article covers HDFC RD interest rates in 2025, how they compare to previous rates, and whether they offer better returns than fixed deposits and other banks. For those looking to optimize their savings strategy, understanding which investment option aligns best with your financial goals is crucial. Exploring structured approaches like recurring deposits or other secure investment alternatives can help build wealth over time.

What are HDFC RD interest rates and how do they work?

A Recurring Deposit (RD) is a financial instrument that allows individuals to deposit a fixed amount regularly, typically monthly, into their RD account. The primary advantage of an RD is that it enables disciplined savings while earning interest comparable to Fixed Deposits (FDs).

HDFC Bank's Recurring Deposit (RD) scheme allows individuals to save a fixed amount monthly, earning interest over a predetermined tenure. This disciplined savings approach is ideal for those aiming to accumulate a substantial corpus over time without making a lump-sum investment.

Interest rates

As of February 2025, HDFC Bank offers the following interest rates on Recurring Deposits (RDs). Senior citizens receive an additional 0.50% interest rate, with an extra 0.25% for tenures above 5 years and up to 10 years. Investors looking for stable and secure returns often compare these rates with HDFC FD interest rates, as fixed deposits remain a popular choice for those seeking low-risk investments with predictable returns. Understanding the latest FD and RD rates can help investors optimize their savings strategy based on their financial goals and liquidity needs.

| Tenure | General Citizens | Senior Citizens |

|---|---|---|

| 6 months | 4.50% | 5.00% |

| 9 months | 5.75% | 6.25% |

| 12 months | 6.60% | 7.10% |

| 15 months | 7.10% | 7.60% |

| 24 months | 7.00% | 7.50% |

| 27 months | 7.00% | 7.50% |

| 36 months | 7.00% | 7.50% |

| 39 months | 7.00% | 7.50% |

| 48 months | 7.00% | 7.50% |

| 60 months | 7.00% | 7.50% |

| 90 months | 7.00% | 7.75% |

| 120 months | 7.00% | 7.75% |

How it works

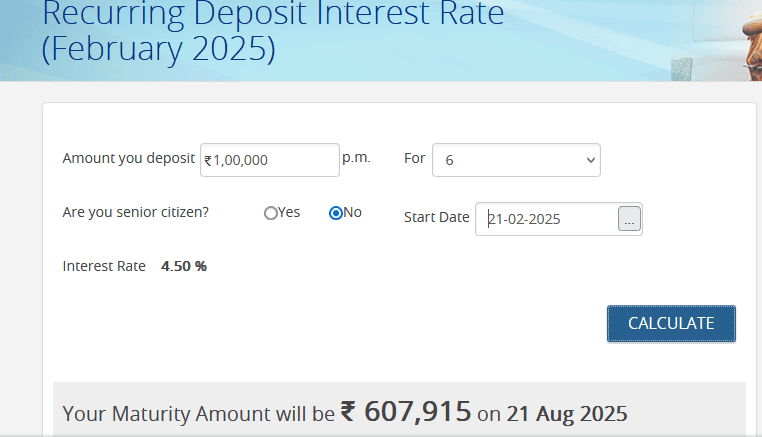

1. Monthly deposits. Investors commit to depositing a fixed amount monthly, starting from a minimum of ₹1,000, in multiples of ₹100.

2. Tenure options. The RD tenure ranges from 6 months to 10 years, allowing flexibility based on financial goals.

3. Interest calculation. Interest is compounded quarterly, enhancing the effective return on investment.

4. Maturity. Upon completion of the chosen tenure, the investor receives the total amount deposited plus the accumulated interest.

Key features

● Fixed interest rates. The interest rate remains constant throughout the RD tenure, ensuring predictable returns.

● Nomination facility. Account holders can nominate a beneficiary for their RD account.

● Premature withdrawal. While early withdrawal is permitted, it may attract a penalty, and the interest will be adjusted accordingly.

● Loan against RD. Investors can avail loans up to 90% of the RD's value, offering liquidity without breaking the deposit.

Tax implications

Interest earned on RDs is taxable. If the total interest exceeds ₹40,000 in a financial year (₹50,000 for senior citizens), TDS is deducted at 10% if PAN details are submitted. Otherwise, TDS is deducted at 20%.

HDFC RD interest rates 2025: What has changed?

As of February 2025, HDFC Bank has made notable adjustments to its recurring deposit (RD) interest rates compared to previous years. These changes reflect the bank's response to evolving market conditions and monetary policies.

Key changes in interest rates

● Short-term deposits (6 to 9 months). The interest rate for a 6-month tenure has been adjusted to 4.50%, while the 9-month tenure now offers 5.75%.

● Medium-term deposits (12 to 24 months). For a 12-month RD, the rate is set at 6.60%. The 15-month tenure offers 7.10%, and the 24-month tenure provides 7.00%.

● Long-term deposits (27 months to 120 months). Tenures ranging from 27 months to 120 months now have a uniform interest rate of 7.00%.

Senior citizens continue to benefit from an additional 0.50% interest rate across all tenures, with an extra 0.25% for deposits exceeding 5 years, up to 10 years.

HDFC RD interest rates vs. Fixed deposits: Which is a better option?

When choosing between HDFC Bank's recurring deposit (RD) and fixed deposit (FD), it's important to consider their differences in interest rates, investment structure, and flexibility. Both options cater to different financial goals.

Interest rates comparison

HDFC Bank offers different interest rates for RDs and FDs, depending on the tenure and customer category.

| Tenure | RD (General) | RD (Senior Citizen) | FD (General) | FD (Senior Citizen) |

|---|---|---|---|---|

| 6 months | 4.50% | 5.00% | 3.00% – 4.50% | 3.50% – 5.00% |

| 12 months | 6.60% | 7.10% | 6.10% – 6.60% | 6.60% – 7.10% |

| 24 months | 7.00% | 7.50% | 6.75% – 7.00% | 7.25% – 7.50% |

| 36 months | 7.00% | 7.50% | 7.00% – 7.10% | 7.50% – 7.60% |

| 60 months | 7.00% | 7.50% | 7.00% – 7.40% | 7.50% – 7.90% |

Senior citizens enjoy an additional 0.50% on both RDs and FDs. In certain cases, long-term FDs may offer an extra 0.25% for tenures above five years.

Key differences between RD and FD

| Feature | Recurring deposit (RD) | Fixed deposit (FD) |

|---|---|---|

| Investment structure | Monthly fixed deposits | One-time lump sum investment |

| Minimum deposit | Rs 1,000 per month | Rs 5,000 (varies based on type) |

| Interest payout | Compounded quarterly, paid at maturity | Can be monthly, quarterly, or at maturity |

| Liquidity | Early withdrawal allowed with a penalty | Premature withdrawal possible but may reduce interest earned |

| Loan facility | Up to 90% of deposit amount | Up to 90% of deposit amount |

Which one should you choose?

● Choose RD if you prefer disciplined savings with smaller monthly investments rather than investing a lump sum at once.

● Choose FD if you have a lump sum amount ready and want higher flexibility in interest payouts.

For investors seeking stable, risk-free returns, both options work well, but the choice depends on financial discipline, liquidity needs, and long-term savings goals.

How do HDFC RD interest rates compare to other banks in 2025?

As of February 2025, HDFC Bank offers competitive Recurring Deposit (RD) interest rates compared to other leading banks in India. Here's a comparison of RD interest rates across various banks:

| Bank Name | General Public Rates | Senior Citizen Rates |

|---|---|---|

| HDFC Bank | 4.50% – 7.00% | 5.00% – 7.75% |

| State Bank of India | 6.00% – 7.00% | 6.50% – 7.50% |

| ICICI Bank | 4.75% – 7.20% | 5.25% – 7.75% |

| Kotak Mahindra Bank | 6.00% – 7.40% | 6.50% – 7.90% |

| Axis Bank | 5.75% – 7.20% | 6.25% – 7.85% |

| Bank of Baroda | 5.75% – 7.25% | 6.25% – 7.75% |

| Punjab National Bank | 6.05% – 7.30% | 6.55% – 7.80% |

| Yes Bank | 7.25% – 8.00% | 7.75% – 8.50% |

| Bandhan Bank | 4.50% – 7.85% | 5.25% – 8.35% |

| IndusInd Bank | 5.85% – 7.99% | 7.25% – 8.25% |

Note: Interest rates are subject to change and may vary based on the tenure and deposit amount. Senior citizens typically receive an additional interest rate benefit.

In this context, HDFC Bank's RD interest rates are competitive, especially for longer tenures. However, banks like Yes Bank and IndusInd Bank offer higher rates for certain periods. It's advisable to compare the specific tenure and deposit amount that align with your financial goals before making a decision.

For the most accurate and updated information, please refer to the official websites of the respective banks or visit their branches.

Should you invest in HDFC RD in 2025? Expert insights & recommendations

Financial expert Rinat Gismatullin states that HDFC Bank's Recurring Deposit (RD) scheme offers a unique opportunity for investors to take advantage of the bank's "Dream Deposit" feature, which provides flexibility in deposit amounts and dates. This allows you to match your savings with irregular income patterns, ensuring that your money grows without the strictness of fixed monthly contributions. By using this feature, you can boost your returns even if your cash flow varies, making it perfect for freelancers or those with unpredictable earnings.

Additionally, think about connecting your RD investments with HDFC's "Super Saver" facility, which links your RD account to your savings or current account. This setup lets you reduce your loan interest using the balance in your RD, effectively lowering your overall interest costs. When planning your deposits, comparing returns across banks is essential. Investors often analyze Union Bank FD rates alongside HDFC’s offerings to find the best savings options.

To maximize returns, tools like the FD Calculator SBI help estimate potential earnings based on deposit tenure and amount, ensuring that investors make well-informed financial decisions. By thoughtfully planning your RD deposits and leveraging available banking features, you can enhance liquidity while minimizing debt costs, a combination of benefits that traditional RDs might not provide.

Conclusion

In conclusion, HDFC Bank's updated RD schemes in 2025 present a viable investment avenue for those aiming to build a corpus through regular savings. Bycarefully selecting the tenure and deposit amount, investors can optimize their earnings while maintaining financial stability. HDFC Bank’s RD interest rates remain competitive, making them a strong option for those looking for predictable returns without market-related risks.

For those seeking even better returns, comparing RD interest rates across banks and financial institutions is advisable. Some banks may offer promotional interest rates on specific tenures, which can provide higher earnings than a standard RD. Additionally, online RD calculators, such as the HDFC FD calculator and SBI FD calculator, can help investors estimate their potential earnings before committing.

Before opening an RD account, investors should also consider factors such as premature withdrawal penalties, taxation on RD interest earnings, and the credibility of the financial institution. Since RD interest earnings are taxable under the “Income from Other Sources” category, understanding the tax implications is crucial.

Ultimately, HDFC Bank’s RD schemes in 2025 serve as a secure and efficient savings option for individuals looking to invest systematically. Whether for short-term financial goals or long-term wealth accumulation, these RDs offer a reliable and structured approach to saving.

FAQs

What is the minimum and maximum tenure for an HDFC RD?

HDFC Bank allows customers to open an RD with a minimum tenure of 6 months and a maximum tenure of 10 years. The interest rate varies based on the selected tenure, with longer durations typically offering better returns. Investors should choose a tenure that aligns with their financial goals and liquidity requirements.

Can I withdraw my HDFC RD before maturity?

Yes, premature withdrawal of an HDFC RD is allowed, but it comes with penalties. The interest rate applicable in such cases will be lower than the contracted rate, often reduced by 1% for the actual period the RD was maintained. Additionally, breaking the RD early may impact the overall returns, so it’s advisable to plan accordingly.

Are HDFC RD interest earnings taxable?

Yes, the interest earned on an HDFC RD is subject to taxation under the "Income from Other Sources" category. If the total interest income across all fixed and recurring deposits in a financial year exceeds ₹40,000 (₹50,000 for senior citizens), TDS (Tax Deducted at Source) is applicable at a rate of 10%. Investors should include RD interest earnings in their annual income tax filings to comply with tax regulations.

How does the interest compounding work for HDFC RDs?

HDFC Bank compounds RD interest quarterly, meaning the interest earned every three months is added to the principal. This results in a higher effective yield compared to simple interest calculations. The power of compounding makes RDs a good choice for those looking for steady and systematic savings growth over time.

About the Author

This article was written by Parshwa Turakhiya, a finance professional and content expert at Traders Union. With deep expertise in stock and options trading, technical and fundamental analysis, and equity research, Parshwa has authored over 100 articles covering Forex, crypto, equity, and personal finance.