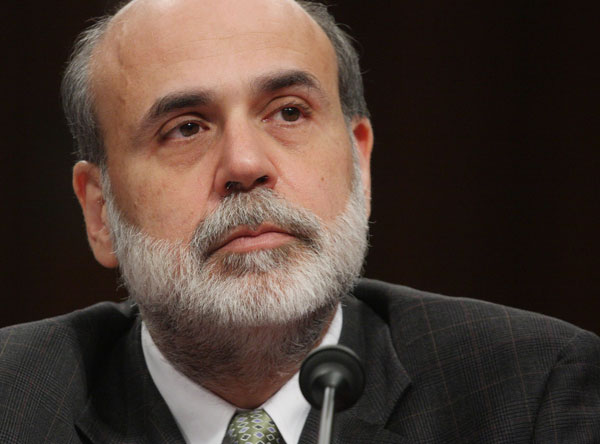

Bernanke seeks broad changes to US financial regulation

Washington - Federal Reserve Chairman Ben Bernanke on Tuesday outlined a broad overhaul of how US financial institutions should be regulated, calling on policymakers to begin remaking the system even as they battle the current economic downturn.

Washington - Federal Reserve Chairman Ben Bernanke on Tuesday outlined a broad overhaul of how US financial institutions should be regulated, calling on policymakers to begin remaking the system even as they battle the current economic downturn.

Bernanke said the focus should be on financial firms of "systemic" importance to the entire system and whose failure could lead to a complete collapse of the economy.

Such "too-big-to-fail" firms like Citigroup Inc, Bank of America Corp and American International Group Inc have received billions of dollars in emergency government loans in the current crisis to help them avoid bankruptcy. Bernanke said such banks would have to be much more closely supervised in future.

"It's not too soon for policy makers to begin thinking about reforms to the financial architecture," Bernanke said in a speech before the Council on Foreign Relations in Washington.

Bernanke also called for an over-arching government regulator that would "focus on risks to the financial system as a whole" and could warn of crises developing in the future.

He said the "patchwork" of current regulatory agencies was part of the reason the United States failed to prevent the current crisis, which stemmed largely from unnecessary risks taken by financial firms in the US housing market.

The US housing collapse has plunged the global economy into recession, sparking calls across the world for massive changes to the way financial firms are regulated.

"If all this would have been in place two or three years ago, we would have been better off today," Bernanke said. (dpa)