AskCred Review : Your personal credit Assistant!

Without an understanding of basic credit concepts, people are not well equipped to make decisions related to financial management. People who are credit literate have the ability to make informed financial choices regarding borrowing, interest rates, savings and more. Such knowledge is especially important in times where increasingly complex financial products are easily available to a wide range of the population. For example, with the Indian government's push to open bank accounts for everyone, the number of people with bank accounts and access to credit products is rising rapidly.

Financial ignorance carries significant costs. Consumers who fail to understand the concept of interest compounding spend more on transaction fees, run up bigger debts, and incur higher interest rates on loans. They also end up borrowing more and saving less money.

Traditional financial education is costly. The complexities of imparting such knowledge in a large and diverse country like India make the problem even harder to solve. What India needs, therefore, is a credit helpline. How do I make a household budget and stick to it? What's the best home loan in the market? How do I decide which bank to choose for a credit card? What’s the fastest way to get a personal loan? What do I do when I feel I am a victim identity theft? Can my low credit score be improved? The obvious approach is to 'Google it' but Google is only a pointer to information sources and cannot guarantee accuracy. Trusted financial advisors are tough to find especially at a scale that India needs. Very often, such advisors are biased and are out to sell products where they maximise their fees with little regard to what the customer really wants or needs.

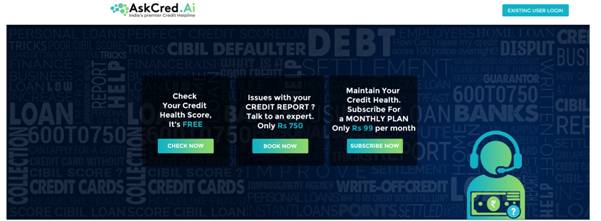

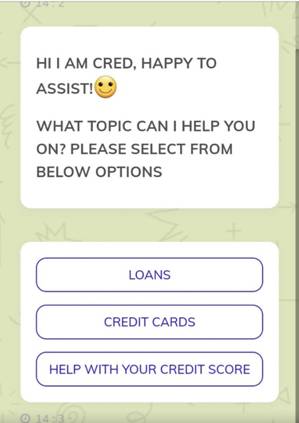

This is where technology could be especially useful. Technology can be used to cut through the credit clutter with a seamless, unbiased, low cost, trustworthy experience while helping users to get accurate and customised knowledge on diverse topics in the complex jargon filled world of retail personal credit. AskCred is one such effort. It is India's first AI based credit helpline which helps users to navigate the financial maze of debt, budgeting, credit cards, debt traps, credit scores and a lot more.

All you have to do is visit www.askcred.com

Ask your question and then follow the conversational flow. It’s free

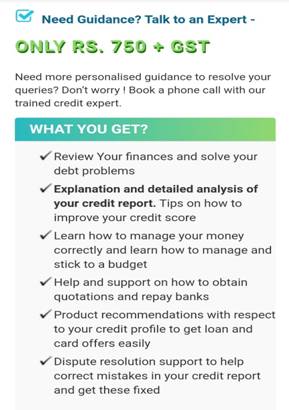

For more customised queries, one can always book a session with a trained credit expert.

All in all, it seems like askcred.com is a novel way to use technology to keep oneself credit literate.

A great effort. Worth using !!!