Arab stocks boosted by global stimulus plans, rising oil prices

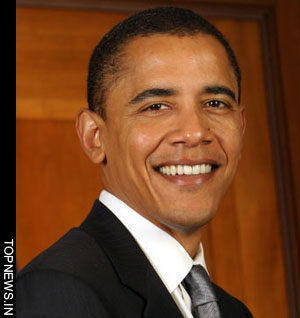

Amman - Arab stock markets advanced across the board this week, receiving momentum from US President Barack Obama's plans to spur the economy, gains scored by global bourses and rising oil prices, financial analysts said Friday.

Amman - Arab stock markets advanced across the board this week, receiving momentum from US President Barack Obama's plans to spur the economy, gains scored by global bourses and rising oil prices, financial analysts said Friday.

However, they warned that the rally could be "short-lived" due to ambiguity surrounding the outcome of blueprints adopted by the world's leading economic powers to handle the economic downturn.

"Obama's plans to use government spending to jump-start growth and reshape the chaotic financial system have reflected positively on Middle East markets," Wajdi Makhamreh, chief operating officer at Amman-based Sanabel International Holding, told the German Press Agency dpa.

"Arab bourses have also received a push from rising oil prices, which help to shore up budgets of oil-rich Gulf countries and provide additional liquidity for regional markets," he said.

"However, we believe that the impact of such psychological factors could turn out to be short-lived, given the lack of clear vision as regards the chances of global efforts giving a helping hand to the faltering world economy," he added.

Makhamreh expected regional stocks to be the target of repeated waves of "speculation and profit taking" in the coming weeks.

Saudi shares scored fresh gains for the second week in a row, with petrochemicals, telecommunications and banking leading the rally. The Tadawul All Share Index (TASI) of the Arab world's largest stock exchange climbed 5.5 per cent, closing at 4,642.99.

TASI is currently 3.3 per cent lower than the year's start, according to the weekly report of the Riyadh-based Bakheet Investment Group (BIG).

Jordanian shares also rallied on news that Iraqi investors were staging a comeback in the wake of visa and residence facilities extended by the Amman government to Iraqi businessmen, Makhamreh said.

The ASE all-share price index gained 2.69 per cent this week, closing at 2,701, according to the market's weekly report.

Kuwaiti shares also improved, boosted by the government's approval of a 5.2-billion-dollar facility to help banks and investment firms facing difficulties as a result of the global financial crisis. Kuwait's KSE all-share price index rose by 1 per cent to close at 6,753.

Kuwaiti Minister of Finance Mustafa Shamali said the stimulus plan was aimed at restoring "stability of the financial system".

The all-sharer price index of the United Arab Emirates stock exchanges of Dubai and Abu Dhabi gained 4.6 per cent to close weekly at 2,554 points.

Egypt's AGX 30 index, measuring the performance of the market's 30 most active stocks, climbed 7.1 per cent, closing at 4,246. (dpa)