Fund Liquidation Weighs by KediaCommodity

Liquidation came from all quarters, including exchange-traded funds, speculators and even physical bullion owners in China and India, the world's largest bullion markets. Investors cut exposure to gold, with total holdings at the world's major bullion gold-backed exchange-traded-funds falling to their lowest since early 2012.

Traders also cited liquidation by prominent hedge funds in gold exchange traded funds, especially the SPDR Gold Trust, which was one of the most-active trading U. S. stocks. The gold ETF posted a record monthly outflow in February. Paulson & Co, run by billionaire financier John Paulson and by far the biggest shareholder in SPDR Gold, told clients earlier this month its gold fund suffered double-digit losses during the first quarter.

The reversal of yen carry trades, in which investors borrowed cheaply in the Japanese currency to reinvest the money in higher yield assets, also led to some gold selling as the yen rebounded from a four-year low against the dollar.

Rupee - Rupee rose toward a seven-week high on optimism falling oil and gold prices will help narrow a record current-account deficit. Crude has slipped 11 percent this month, and that will help cut imports in a nation that gets about 80 percent of its oil from abroad.

The price of gold, which the central bank estimates accounts for two-thirds of the current-account gap, fell 14 percent. The shortfall was as high as 5 percent of gross domestic product in the fiscal year ended March 31, Finance Minister Palaniappan Chidambaram said this week.

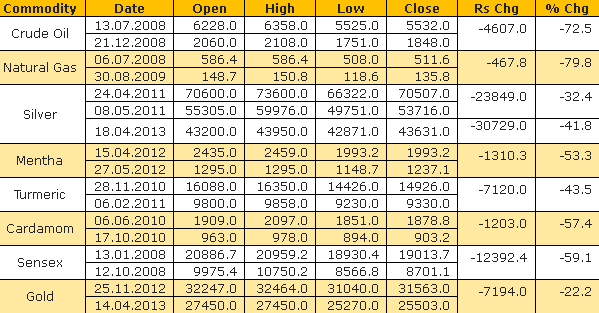

Surprised.. While going to the above table we can see a life cycle of the fall in the prices whether it is Crude oil, Menthaoil, Cardamom or even Sensex we have seen whenever there is a fall in prices, prices dropped beyond -100% from the high of the commodity or index. Same can be seen from the above table, even silver has dropped nearly -71.60% from its high of Rs. 73600/1kg to today low of Rs. 42871/1kg while gold dropped only -27.60% so there is more space for fall in prices.