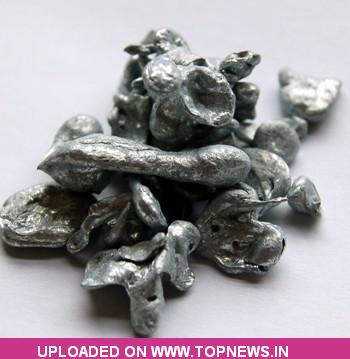

Commodity Trading Tips for Zinc by KediaCommodity

Zinc yesterday traded with the negative node and settled -0.14% down at 103.6 tracking LME zinc prices dipped to as low as USD 2,058.3/mt during Asian trading hours yesterday. The US National Association of Home Builders said yesterday that its housing market index rose to near 5-year high in March. The US dollar index lost previous gain, helping boost LME zinc prices, with prices gradually returning to near 5-day moving average and finally closing at USD 2,084/mt, up USD 9/mt. The Greek CDS auction was completed on Monday, settling at 21.5%, or a discount of 78.5% to face value, reducing market concern over implementation of the second round Greek bailout plan. In response, the euro gained upward momentum and advanced slightly. In addition, lower than expected readings on US manufacturing exerted downward pressure on the US dollar. The weakening US dollar will help boost base metal prices. In response, LME base metal prices advanced overnight. However, players' concern over financial conditions in Portugal and Spain capped gains of LME base metal prices. No negative news is expected to be released from the euro zone in the short term, which will support euro. At present, market sentiment is positive, and impact from Fed’s interest rate meeting is waning. In addition, the US dollar is weak in the short term. For today's session market is looking to take support at 102.9, a break below could see a test of 102.3 and where as resistance is now likely to be seen at 104.2, a move above could see prices testing 104.9.

Zinc yesterday traded with the negative node and settled -0.14% down at 103.6 tracking LME zinc prices dipped to as low as USD 2,058.3/mt during Asian trading hours yesterday. The US National Association of Home Builders said yesterday that its housing market index rose to near 5-year high in March. The US dollar index lost previous gain, helping boost LME zinc prices, with prices gradually returning to near 5-day moving average and finally closing at USD 2,084/mt, up USD 9/mt. The Greek CDS auction was completed on Monday, settling at 21.5%, or a discount of 78.5% to face value, reducing market concern over implementation of the second round Greek bailout plan. In response, the euro gained upward momentum and advanced slightly. In addition, lower than expected readings on US manufacturing exerted downward pressure on the US dollar. The weakening US dollar will help boost base metal prices. In response, LME base metal prices advanced overnight. However, players' concern over financial conditions in Portugal and Spain capped gains of LME base metal prices. No negative news is expected to be released from the euro zone in the short term, which will support euro. At present, market sentiment is positive, and impact from Fed’s interest rate meeting is waning. In addition, the US dollar is weak in the short term. For today's session market is looking to take support at 102.9, a break below could see a test of 102.3 and where as resistance is now likely to be seen at 104.2, a move above could see prices testing 104.9.

Trading Ideas:

Zinc trading range for the day is 102.27-104.87.

Zinc downside was limted after U.S NAHB said yesterday that its housing market index rose to near 5-year high in March

Players' concern over financial conditions in Portugal and Spain capped gains of base metal prices

The US NAHB said yesterday that its housing market index rose to near 5-year high in March