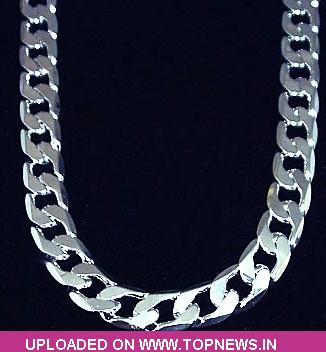

Commodity Trading Tips for Silver by KediaCommodity

Silver continued to recover on short covering from last week's correction, and technical charts suggested the metal could stabilize after bouncing off a key support level. Silver is closing the week lower at 53716. This week we saw an early bounce to the 38.2% retracement level of 59950 before setting fresh lows to 49751. We have an 8 month support line at 49500 drawn off the August and January lows. A break of this opens up a return to 40000. The Gold Silver ratio is closing higher for the third week in a row at 42.69. The key topside resistance is seen at 45.68 which is the 38.2% Fibo of the 68.34 to 31.68 down move. Now technically market is trading in the range as RSI for 18days is currently indicating 39.08, where as 50DMA is at 60173.14 and silver is trading below the same and getting support at 53534 and below could see a test of 53351 level, And resistance is now likely to be seen at 54026, a move above could see prices testing 54335.

Silver continued to recover on short covering from last week's correction, and technical charts suggested the metal could stabilize after bouncing off a key support level. Silver is closing the week lower at 53716. This week we saw an early bounce to the 38.2% retracement level of 59950 before setting fresh lows to 49751. We have an 8 month support line at 49500 drawn off the August and January lows. A break of this opens up a return to 40000. The Gold Silver ratio is closing higher for the third week in a row at 42.69. The key topside resistance is seen at 45.68 which is the 38.2% Fibo of the 68.34 to 31.68 down move. Now technically market is trading in the range as RSI for 18days is currently indicating 39.08, where as 50DMA is at 60173.14 and silver is trading below the same and getting support at 53534 and below could see a test of 53351 level, And resistance is now likely to be seen at 54026, a move above could see prices testing 54335.

Trading Ideas:

Silver trading range is 53351-54335.

Silver continued to recover on short covering from last week's correction

Silver is having resistance at 54026 and support at 53534 level.

Holdings at ishares silver trust rose by 18.20 tonnes to 10534.41 tonnes